Nick D'Argenzio

Partner & Co-Founder Blvd Real Estate Investment Co.

Nick has extensive experience in real estate development, investment, and brokerage working on mixed-use, multi-family, for-sale housing, retail, and office development projects. Nick is a graduate of the University of Southern California, where he received a Master’s Degree in Real Estate Development (MRED) and is an active guest lecturer and alumni. He is currently an Instructor at UCLA teaching Real Estate Development and Shopping Center Development courses. He has worked as Regional Director and Senior Development & Investment Manager with best-in-class development firms such as FivePoint Communities (Formerly Lennar Urban) (NYSE: FPH), Regency Centers (NYSE: REG) and others. Nick has experience managing across the investment cycle including acquisitions, entitlements, pre-development, design, leasing, construction, and stabilization for numerous high-profile projects including landmark urban mixed-use developments. Notable projects include both Candlestick Park and the Naval Shipyard redevelopment in the San Francisco, an infill -urban 700 acre waterfront master planned development. Candlestick Park included +/-500,000 SF lifestyle retail shopping district with grocery, theater, shops, and restaurants in addition to over a million square feet of hotels, office, residential, and affordable housing. The San Francisco Shipyard includes over five million square feet of office and commercial. Across the Bay Area, Nick worked on mid-sized infill redevelopments of blighted shopping centers and industrial for conversion to mixed-use and for-sale housing with a small residential development company. In Los Angeles, Nick successfully completed the ground up development and re-development of multiple regional shopping centers including anchors such as Whole Foods, Gelsons Market, and other supermarkets. In Orange County, Nick worked with Faris Lee Investments, a real estate investment brokerage as lead financial underwriter responsible for approximately $5 billion of assets composed of hundreds of shopping centers across the United States and as an investment associate he sourced off-market opportunities and worked on transactions worth over $150 million.

- LanguagesEnglish

- MarketsInland Empire (California), Los Angeles, Orange County (California), Salt Lake City

- Property TypesIndustrial, Land, Office, Retail, Flex, Multifamily

- Websites

- Company WebsiteVisit Site

- EducationGraduate Degree in International Business Practices from St. Mary’s University College of Twickenham, in London, U.K, and his B.B.A. in Finance, with a concentration in Real Estate, from the University of North Florida.

$2,949,000 USD

Office/Residential - For Sale4,500 SF | 9% Cap Rate

$1,150,000 USD

Commercial Land - For Sale22,216 SF

$20,000,000 USD

Drug Store - For Sale12,277 SF | Request Cap Rate

$1,399,000 USD

Apartments - For Sale3,539 SF | Request Cap Rate

$7,950,000 USD

Retail - For Sale120,266 SF | 1.64% Cap Rate

$750,000 USD

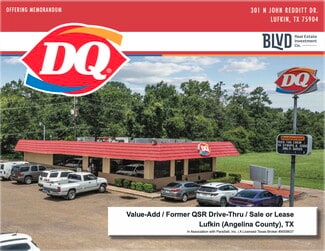

Fast Food - For Sale2,736 SF | Request Cap Rate

$6,500,000 USD

Drug Store - For Sale21,440 SF | Request Cap Rate

$21.00-$27.00 USD /SF/yr

Office/Medical - For Rent

$4,250,000 USD

Auto Repair - For Sale21,032 SF | 8.5% Cap Rate

RENT WITHHELD

Retail - For Rent