607-621-0439

SPG Student Housing Portfolio

Binghamton, NY

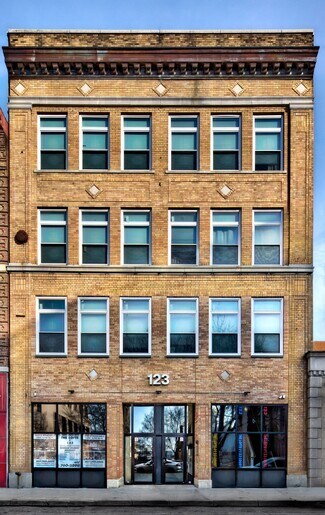

Center City

HIGHLIGHTS

- 35 buildings totaling 121 units and 409 beds concentrated in Downtown Binghamton and the West Side, the city’s strongest student housing markets.

- Supported by Binghamton University’s 18,000 students and limited on-campus housing, ensuring consistent occupancy and rent stability.

- Available at just 5%, providing operational efficiency, continuity, and immediate scalability.

- Located in New York’s Southern Tier, where university growth, healthcare investment, and downtown redevelopment continue to drive investor activity.

OVERVIEW

The offering includes 35 buildings with 121 units and 409 beds concentrated in Downtown Binghamton and the West Side, the city’s most established and highest-performing student housing markets. All properties are zoned R3 or Commercial and located within walking distance of the SUNY bus line, ensuring consistent demand and long-term operational stability.

In addition to the full portfolio, investors may also consider three targeted compositions: the West Side Portfolio, the Downtown Proximity Portfolio, and the Downtown Core Portfolio. Each provides a distinct scale and investment profile, allowing buyers to align acquisitions with their preferred balance of income and growth potential.

This portfolio represents institutional-scale housing within a proven and expanding university-driven market. Binghamton University’s enrollment exceeds 18,000 students, with fewer than 7,600 on-campus beds, driving sustained off-campus housing demand. The region continues to benefit from university expansion, healthcare sector growth, and ongoing downtown revitalization that is drawing renewed investor interest.

Professional management is in place at an efficient 5% fee, ensuring operational continuity and scalability. With steady rent growth, limited new supply, and increasing investment momentum, the portfolio offers durable cash flow and long-term appreciation potential in one of Upstate New York’s strongest emerging markets.

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

607-621-0439

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

607-621-0439

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.