$2,900,000 USD

717-554-4881

Scranton New Construction Portfolio

Scranton, PA

South Side

OVERVIEW

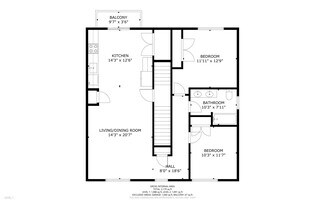

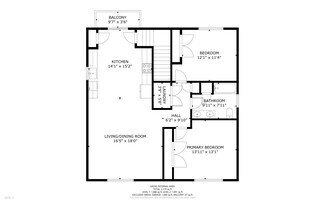

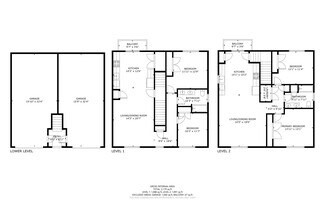

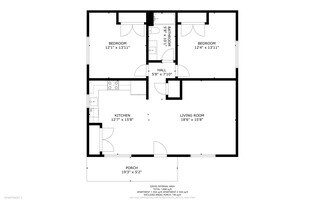

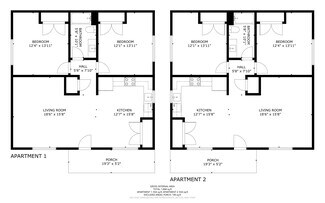

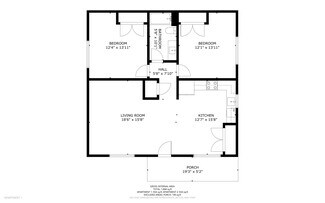

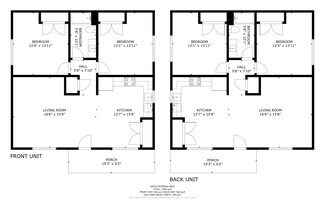

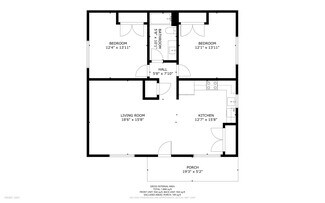

Scope Commercial Real Estate Investment Services is pleased to exclusively present for sale The

Scranton New Construction Duplex Portfolio, a collection of 14 newly-built units in 7 properties. The

properties are located at 119 Prospect Avenue, 216 Harrison Avenue, 525 Harrison Avenue, 627

Prescott Avenue, 629 Prescott Avenue, 702 E. Elm Street, and 708 Harrison Avenue, all in Scranton, PA.

Each property contains 2 units.

All of the properties have secured 10-year tax abatements, and all the properties have fully separated

utilities placing all utility charges on the tenants. The units have central air, stainless steel appliances,

spray foam insulation, granite countertops, and plentiful off-street parking. The average rent per bed in

the portfolio is approximately $1,698 per month, with potential for further rental increases. The portfolio

grosses approximately $285,000 in annual rental income, with a low expense load of 13.6% due to tax

abatements and efficiencies generated from new construction. The portfolio generates a net operating

income of approximately $246,000.

In the Scranton multifamily market, over the past year, multifamily rents have increased by 3.3%,

reaching an average of $1,400 per month, indicating strong demand. The market has seen 13 units of net

deliveries with no new construction currently underway, suggesting a balanced market with limited

competition. Sales activity has been robust, with 16 transactions totaling approximately $7 million in

volume, reflecting investor confidence. The vacancy rate stands at a manageable 5.4%, lower than the

national average, indicating a tight rental market favorable for landlords and investors.

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

717-554-4881

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

717-554-4881

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.