$5,250,000 USD

646-245-3254

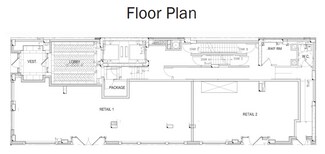

Retail Condominiums 1380 Madison Ave.

New York, NY

East Harlem

HIGHLIGHTS

- Prime Upper East Side Madison Avenue frontage in an iconic neighborhood setting.

- Surrounded by high-income residential blocks and steady daily pedestrian movement.

- Close proximity to Central Park, Museum Mile, and multiple cultural institutions.

- Strong transit access with nearby 4/5/6 and Q subway lines supporting customer draw.

- Two nationally recognized, credit-worthy tenants.

OVERVIEW

This rare opportunity consists of two high-quality retail condominium units offered together at a combined purchase price of $5,250,000. The assets are anchored by two nationally recognized, credit-worthy tenants: Bank of America and Van Leeuwen Ice Cream. Both tenants recently executed new long-term leases, providing the incoming investor with stable income and minimal near-term rollover.

The property benefits from strong tenant branding, established customer traffic, and essential-service draw. Bank of America offers long-term credit stability, while Van Leeuwen adds a modern, experience-driven retail component that appeals to a wide demographic. The pairing creates an attractive and diversified income stream.

The asset is projected to generate a 2026 Net Operating Income of $240,000, offering investors durable cash flow backed by reputable operators. With new leases in place, minimal capital requirements, and two well-performing tenants, this offering is ideally suited for investors seeking secure, low-management retail income.

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

646-245-3254

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

646-245-3254

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.