Jeff Lefko

Retail investment professional

As Executive Vice President and Partner at Hanley Investment Group, Jeff Lefko specializes in advising clients in the acquisition and disposition of retail properties nationwide. Jeff is focused on developing meaningful relationships that go beyond a singular transaction by proactively advising his clients to help achieve their long-term financial goals and objectives. Jeff’s commitment to his clients and his relationship-first mindset have allowed him to close $3.5 billion in sales since 2017, averaging over 100 deals per year (since 2020). His outstanding track record earned him Hanley Investment Group’s “Top Producer” from 2019 to 2024. In 2017, Jeff was awarded Hanley Investment Group’s “Honor Man” award for his immediate success and exceptional performance at the company. Jeff and his longtime colleague, Bill Asher, were honored by GlobeSt. as Influencers in Retail and Influencers in Net Lease in 2020, 2021, 2022, 2023, and 2024. Jeff also received GlobeSt.’s CRE’s Aspiring Leaders of 2024 and “Fifty Under 40” in 2022, which recognize talented professionals, under the age of 40, who hold solid track records of noteworthy transaction volume and significant contributions to their company’s overall success and stand out among their counterparts in the commercial real estate industry. Jeff and Bill were also recognized CoStar Power Brokers winning CoStar Power Broker Quarterly Deal Awards in 2021, 2022, 2023, and 2024 in multiple U.S. markets. Jeff was also awarded the ICSC Schurgin Foundation Entrepreneurial Award, given to one member each year who exhibits an entrepreneurial spirit towards the industry; Jeff remains an active member of ICSC. Graduating Summa Cum Laude from the University of San Diego, Jeff holds a bachelor’s degree in real estate as well as a culinary degree from the Broadmoor Culinary School. A resident of San Diego, Jeff enjoys spending his free time cooking for his wife, family, and friends, playing pickleball, and cheering on his hometown sports teams, the Kansas City Royals and Chiefs.

- SpecialtiesInvestment Sales Broker

- LanguagesEnglish

- MarketsChicago, Cincinnati/Dayton, Dallas/Ft Worth, Indianapolis, Inland Empire (California), Kansas City, Los Angeles, Orange County (California), Portland, St. Louis, Albuquerque, Bakersfield, Beaumont/Port Arthur, Boise City/Nampa, Peoria

- Property TypesIndustrial, Land, Retail, Specialty

- Websites

- Company WebsiteVisit Site

- EducationB.A. in Real Estate and graduated Summa Cum Laude from University of San Diego

- OrganizationsInternational Council of Shopping Centers (ICSC)

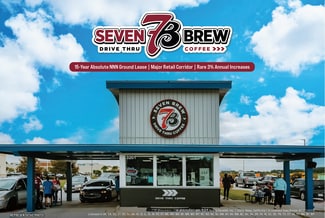

$7,180,000 USD

Freestanding - For Sale3,342 SF | 7% Cap Rate

$2,060,000 USD

Freestanding - For Sale1,721 SF | 6.75% Cap Rate

$6,830,000 USD

Retail - For Sale34,317 SF | 7% Cap Rate

$9,335,000 USD

Warehouse - For Sale27,050 SF | 6.5% Cap Rate

$3,745,000 USD

Service Station - For Sale3,636 SF | 5.15% Cap Rate

$1,417,000 USD

Fast Food - For Sale2,882 SF | 6% Cap Rate

$1,250,000 USD

Freestanding - For Sale1,682 SF | 6% Cap Rate

$6,450,000 USD

Retail - For Sale7,000 SF | 5.15% Cap Rate

$1,364,000 USD

Retail - For Sale1,663 SF | 5.5% Cap Rate

$4,205,000 USD

Retail - For Sale1,663 SF | 5.35% Cap Rate

$3,875,000 USD

Retail - For Sale5,920 SF | 5.85% Cap Rate

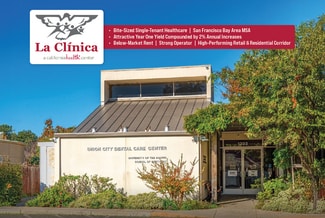

$1,718,000 USD

Medical - For Sale5,369 SF | 7.5% Cap Rate

$3,085,000 USD

Retail - For Sale2,325 SF | 5.35% Cap Rate

$3,825,000 USD

Freestanding - For Sale7,000 SF | 6% Cap Rate

$3,775,000 USD

Freestanding - For Sale6,863 SF | 6% Cap Rate

$3,906,000 USD

Retail - For Sale4,200 SF | 5.35% Cap Rate

$5,200,000 USD

Car Washes - For Sale8,000 SF | 6.25% Cap Rate

$7,310,000 USD

Car Washes - For Sale3,882 SF | 6.35% Cap Rate

$8,725,000 USD

Freestanding - For Sale18,500 SF | 5.65% Cap Rate

$6,666,000 USD

Car Washes - For Sale5,721 SF | 6.75% Cap Rate

$6,666,000 USD

Car Washes - For Sale6,164 SF | 6.75% Cap Rate

$5,405,000 USD

Retail - For Sale40,614 SF | 7.5% Cap Rate

$3,110,000 USD

Restaurant - For Sale2,646 SF | 4.5% Cap Rate

$3,272,000 USD

Restaurant - For Sale2,300 SF | 5.35% Cap Rate

$5,845,000 USD

Car Washes - For Sale5,800 SF | 7.25% Cap Rate

$1,200,000 USD

Freestanding - For Sale7,381 SF | 4.5% Cap Rate

$1,333,000 USD

Storefront - For Sale540 SF | 6% Cap Rate

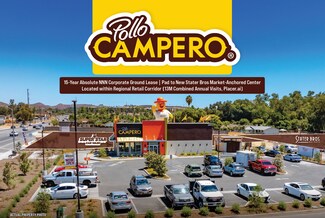

$4,785,000 USD

Fast Food - For Sale1,650 SF | 4.85% Cap Rate

$4,495,000 USD

Retail - For Sale8,043 SF | 6.2% Cap Rate

$6,045,000 USD

Day Care Center - For Sale11,000 SF | 6.75% Cap Rate