Bill Asher

Retail investment professional specializing in advising clients in the acquisition and disposition of retail properties nationwide

As an Executive Vice President for Hanley Investment Group, Bill Asher specializes in advising clients in the acquisition and disposition of retail properties nationwide. With over 19 years of experience in commercial real estate, his transaction expertise, industry relationships and unparalleled professionalism have allowed him to close and contribute to in excess of one billion dollars in sales, including over 135 sales since 2009. Bill’s dedication and unwavering commitment to his clients has made him one of the top agents at the company including earning him the “Top Producer Award” as the #1 Performer at Hanley Investment Group in 2017, 2013 and runner-up in 2014. For more than 16 years Bill has worked diligently with the Hanley team on the coordination and supervision of strategic marketing and operation initiatives as well as distribution and implementation of corporate advertising, public relations and tactical macro company objectives to ensure seamless and successful closings on behalf of every client. Prior to helping form Hanley Investment Group in 2004, Bill was a member of the Newport Beach office of Marcus & Millichap from 2002-2004, where he concentrated on investment sales of retail properties. From 2000-2002, Bill was a Market Analyst and Associate with Cushman Realty Corporation/Cushman & Wakefield. Bill specialized in providing tenant advisory and transactional services to clients on a local, regional and national basis. Bill contributed to many prominent tenant representation assignments for clients that included ADP, Fox Sports Net, Jacobs Engineering and the Los Angeles Times. Bill graduated from the University of Arizona with a Bachelor of Science Degree in Business with an emphasis in Marketing. He is an active member of the International Council of Shopping Centers. He also serves as a mentor for Big Brothers Big Sisters of Los Angeles. Bill lives in South Orange County with his wife and two daughters. He enjoys spending time with family, traveling, golfing, and keeping up on University of Arizona basketball and football. CA Lic. # BRE #01318078 NV Lic. #COOP.0000245-AUTH

- SpecialtiesInvestment Sales Broker

- LanguagesEnglish

- MarketsChicago, Dallas/Ft Worth, Indianapolis, Inland Empire (California), Kansas City, Los Angeles, Orange County (California), Sacramento, St. Louis, Salt Lake City, Albuquerque, Bakersfield, Boise City/Nampa

- Property TypesLand, Office, Retail, Specialty

- Websites

- Company WebsiteVisit Site

- EducationB.S. in Administration and Management from University of Arizona

- OrganizationsInternational Council of Shopping Centers (ICSC)

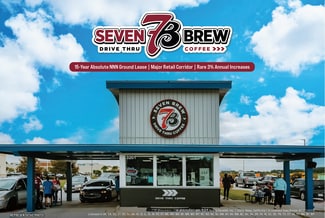

$7,180,000 USD

Freestanding - For Sale3,342 SF | 7% Cap Rate

$2,060,000 USD

Freestanding - For Sale1,721 SF | 6.75% Cap Rate

$6,830,000 USD

Retail - For Sale34,317 SF | 7% Cap Rate

$9,335,000 USD

Warehouse - For Sale27,050 SF | 6.5% Cap Rate

$3,745,000 USD

Service Station - For Sale3,636 SF | 5.15% Cap Rate

$1,417,000 USD

Fast Food - For Sale2,882 SF | 6% Cap Rate

$1,250,000 USD

Freestanding - For Sale1,682 SF | 6% Cap Rate

$6,450,000 USD

Retail - For Sale7,000 SF | 5.15% Cap Rate

$1,364,000 USD

Retail - For Sale1,663 SF | 5.5% Cap Rate

$4,205,000 USD

Retail - For Sale1,663 SF | 5.35% Cap Rate

$3,875,000 USD

Retail - For Sale5,920 SF | 5.85% Cap Rate

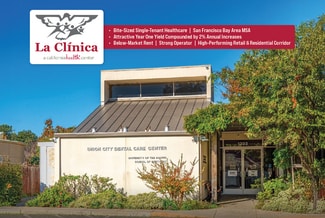

$1,718,000 USD

Medical - For Sale5,369 SF | 7.5% Cap Rate

$3,085,000 USD

Retail - For Sale2,325 SF | 5.35% Cap Rate

$3,825,000 USD

Freestanding - For Sale7,000 SF | 6% Cap Rate

$3,775,000 USD

Freestanding - For Sale6,863 SF | 6% Cap Rate

$3,906,000 USD

Retail - For Sale4,200 SF | 5.35% Cap Rate

$5,200,000 USD

Car Washes - For Sale8,000 SF | 6.25% Cap Rate

$7,310,000 USD

Car Washes - For Sale3,882 SF | 6.35% Cap Rate

$8,725,000 USD

Freestanding - For Sale18,500 SF | 5.65% Cap Rate

$5,405,000 USD

Retail - For Sale40,614 SF | 7.5% Cap Rate

$7,280,000 USD

For Sale6,109 SF | 5% Cap Rate

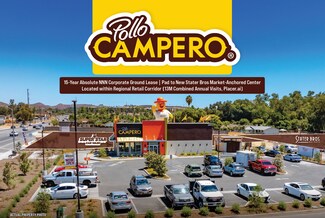

$3,110,000 USD

Restaurant - For Sale2,646 SF | 4.5% Cap Rate

$3,272,000 USD

Restaurant - For Sale2,300 SF | 5.35% Cap Rate

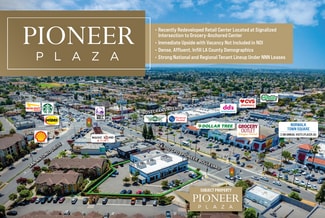

$18,170,000 USD

Retail - For Sale21,117 SF | 5.25% Cap Rate

$5,845,000 USD

Car Washes - For Sale5,800 SF | 7.25% Cap Rate

$1,333,000 USD

Storefront - For Sale540 SF | 6% Cap Rate

$4,785,000 USD

Fast Food - For Sale1,650 SF | 4.85% Cap Rate

$4,495,000 USD

Retail - For Sale8,043 SF | 6.2% Cap Rate

$6,045,000 USD

Day Care Center - For Sale11,000 SF | 6.75% Cap Rate

$5,340,000 USD

Health Club - For Sale10,516 SF | 6% Cap Rate