818-519-1429

A++ Retail and Residential Collection

Los Angeles, CA

Silver Lake

HIGHLIGHTS

- ±18,911 SF mixed-use asset comprising ±14,500 SF of retail and restaurant space plus six residential apartments totaling ±4,411 SF in Silver Lake

- Premier Sunset Boulevard Location in the High-Demand Silver Lake Submarket

- Curated Retail Tenant Roster on NNN Leases with Rent Growth

- Five Fully Permitted Liquor Licenses & Full Conditional Use Permit (CUP) for Rooftop Activation

- Stable, Long-Term Income with Upside for both the Retail & Apartments

- Institutional-Quality Asset with Limited CapEx

OVERVIEW

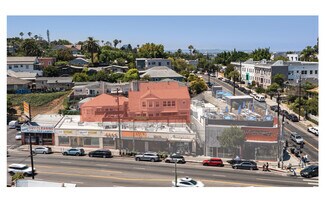

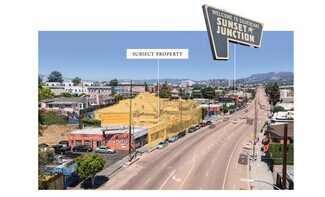

Matthew Luchs of Zacuto Group is pleased to exclusively present the opportunity to acquire 3814–3828 West Sunset Boulevard, a rare and highly coveted ±18,911 square foot (including rooftop) mixed-use investment property situated on 14,910 square feet of land located in the heart of Silver Lake, one of Los Angeles’ most culturally vibrant and economically resilient neighborhoods.

This offering presents a unique opportunity to acquire a stabilized, cashflowing asset in one of the most dynamic submarkets in Southern California. With an institutional-quality tenant roster, secure long-term leases, belowmarket residential rents, and limited near-term capital requirements, 3814–3828 West Sunset Boulevard is ideally suited for both private and institutional investors seeking a well-located mixed-use asset with durable income and long-term value appreciation potential.

This premier asset consists of approximately 14,500 square feet of fully leased retail and restaurant space across ten ground-floor suites, as well as six residential apartment units totaling approximately 4,411 square feet located above the commercial storefronts. The property is strategically positioned along one of the city’s most recognizable and heavily trafficked commercial corridors, offering direct exposure to over 38,000 vehicles per day and significant pedestrian activity from the surrounding dense, high-income residential population. 3814–3828 West Sunset Boulevard is located in the epicenter of Silver Lake, a neighborhood

that continues to outperform most Los Angeles submarkets in terms of both retail and multifamily fundamentals. The property is surrounded by a diverse mix of high-end retailers, acclaimed restaurants, coffee shops, entertainment venues, and boutique fitness studios, all contributing to the vibrant, walkable environment that defines the Sunset Boulevard corridor.

The location also benefits from proximity to major thoroughfares such as the 101 and 5 Freeways, which provide convenient access to Hollywood, Downtown Los Angeles, Glendale, and Burbank. The surrounding demographics are exceptionally strong, with nearly 500,000 residents within 5 miles and average household incomes exceeding $80,000.

The ground-floor retail spaces are fully leased to a curated lineup of well-established, experience-driven tenants, including Le Labo Fragrances and Garrett Leight California Optical, as well as popular local operators such as Wasteland, Naturewell, Bar Seco, Santo Sushi, Yala Coffee, and Pi LA. These tenants are destination-oriented and synergistic, creating an activated street presence that draws consistent foot traffic throughout the week.

Most leases are structured as triple-net, with 3% annual rental increases, contributing to minimal landlord responsibilities and predictable income growth. The current average retail rent is approximately $9.52 per square foot per month, with pro-forma rents reaching an average of $13.57 per square foot, reflecting both the quality of tenancy and the upward momentum of the W Sunset Boulevard retail market. The weighted average remaining lease term across the commercial portfolio is approximately 6.41 years, offering stability and cash flow to a prospective investor.

The residential portion of the property consists of six highly renovated apartment units featuring state-of-the-art appliances, Euro kitchens, in-unit washer and dryers, honey wheat colored wood floors, farmhouse sinks, butcher-block counter tops, custom-tiled baths, and gorgeous finishes, comprising a balanced mix of one-bedroom and two-bedroom layouts, with an average unit size of approximately 735 square feet. Five units are currently occupied, with tenants demonstrating strong tenancy histories and long average durations of stay.

The current average rent across the residential units is $2,819 per month, or approximately $4.00 per square foot, while pro forma rents are projected at an average of $3,525 per month, or $4.83 per square foot. The residential component provides meaningful upside through natural turnover and repositioning, as most units remain significantly below market rates. With the high demand for housing in the Silver Lake submarket, the residential income can be further enhanced over time, complementing the already robust performance of the retail component.

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

818-519-1429

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

818-519-1429

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.