$6,000,000 USD

512-656-5787

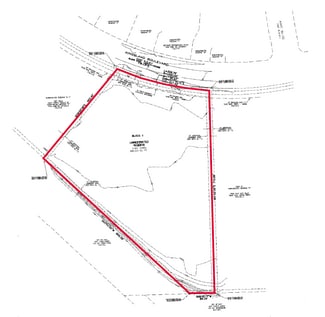

Kingsland Blvd

Katy, TX 77494

Cinco Ranch

OVERVIEW

Investment Snapshot:

Capital Ask: $6M Preferred Equity (10–12% return, senior to sponsor equity or a fixed return)

$3M land buyout from bank. Appraised for $5.5 million as is.

$3M horizontal development (roads, utilities, pads)

Appraised Value: ~$12M post-horizontal (3rd party bank appraisal attached)

Completion Value: ~$37M at full build-out

Sponsor Equity: ~$3M already invested (land, drainage, water systems, carrying costs)

Exit: Refinance, pad/shell sales, or bulk sale

Highlights:

Strong Equity Cushion – $12M appraisal vs. $6M raise

De-Risked – Drainage & water systems complete; all work bonded

Revenue Model – Pad buyers fund shells in stages ? predictable inflows

Market Demand – 14 planned buildings; 3 already under contract with medical/professional users

Track Record – 250,000+ sq. ft. delivered in Katy/Sealy; established city & banking ties, Local Resident and Investor

FOR SALE DETAILS

PRICE

$6,000,000 USD

PRICE/ACRE

$916,451/AC

PRICE/SF

$21 USD /SF

# OF LOTS

-

LAND DETAILS

PROPERTY TYPE

Land

PROPERTY SUBTYPE

Commercial

LAND PROPOSED USE

Commercial, Office, Day Care Center, Medical, Office Park, Storefront Retail/Office

LAND ACRES

6.55 AC

LAND SF

285,187 SF

OFFSITE IMPROVEMENTS

Sewer, Water, Electricity, Gas, Streets, Curb/Gutter/Sidewalk, Cable, Telephone, Irrigation

ZONING

None

APN/PARCEL ID

5415-01-000-0042-914

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

512-656-5787

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

512-656-5787

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.