$1,999,000 USD

440-670-2300

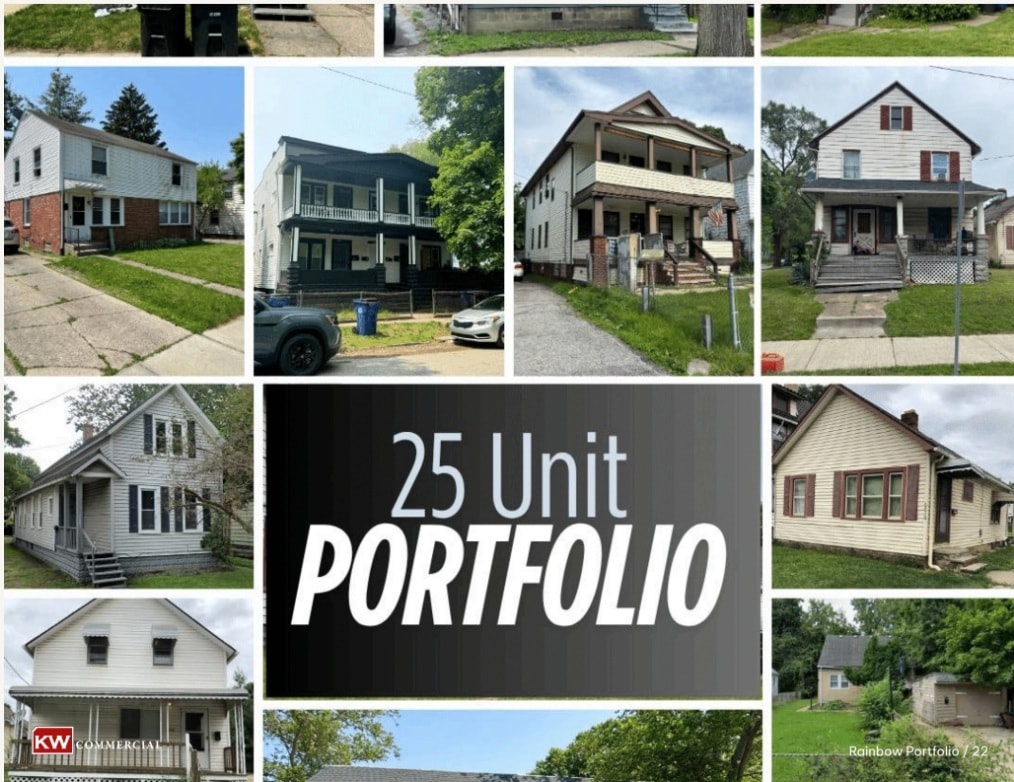

Rainbow Portfolio:14 Properties 25 Units

Cleveland, OH

Old Brooklyn

HIGHLIGHTS

- Section 8 Stability: Reliable income with minimal delinquency or turnover risk.

- Huge rental growth available by bringing rents to Sec 8 market rates and leasing the vacant units

- A rare balance of current income and equity-building potential through appreciation and rent growth.

- Majority of units are located in 44102, one of fastest growing areas between 2 of NEO's hottest markets, Lakewood & Ohio City

OVERVIEW

Cash-Flowing 25-Unit Cleveland Portfolio with Section 8 Stability, Value-Add

This is a rare chance to own a stabilized, income-producing 25-unit portfolio—spread across 14 Cleveland properties in strong, emerging neighborhoods. The package includes 2 quads, 1 triplex, 3 duplexes, and 8 single-family homes, offering diversification and simple management under one umbrella.

The portfolio currently brings in $22,789 per month, with most tenants on Section 8 for consistent, reliable rent collections. The average rent is $912/unit and the proforma is nearly $30,000/month, creating the potential for an extra $84,000 per year once rents are pushed to market and the 4 current vacancies are leased up.

Many units are already updated in some way, so there’s little need for large upfront investment. Current NOI is $141,160, which delivers a 7% cap rate at a $2M purchase price. With an estimated proforma cap rate of over 11% this is a rare opportunity for both strong yield and future equity growth.

Portfolio Snapshot:

Unit Mix: 2 Quads, 1 Triplex, 3 Duplexes, 8 Single-Family Homes

Total Units: 25 (across 14 parcels)

Current Rent Roll: $22,789/month

Proforma Rent Roll: $30,000+/month

Average Rent (current/proforma): $912 / $1,194 per unit

2025 Projected NOI: $141,160

Cap Rate (at $2M): 7%

Cap rate after rent increases: 11.6%

Vacancy: 4 units, actively being listed

Tenant Mix: Primarily Section 8

This portfolio is ideal for investors seeking easy transition, cash flow from day one, room to grow income and equity, and long-term appreciation in one of the Midwest’s most resilient rental markets.

This portfolio offers the opportunity for easy transition, ability to create some equity with little cash input and long term appreciation. Whether you're looking to scale in Cleveland, tap into Section 8 rent stability, or invest in a well-managed portfolio with built-in upside, this opportunity checks all the boxes.

Visit Portfolio map here:

https://www.google.com/maps/d/u/0/edit?mid=1aOfwiWIqrz2RARd2P47bVkbeXjYRJgI&usp=sharing

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

440-670-2300

By clicking the button, you agree to Showcase's Terms of Use and Privacy Policy.

Please correct the highlighted field(s).

440-670-2300

By clicking the button, you agree to Showcase's Terms of Use and Privacy Policy.