GSM & Centurion anchored Portfolio FOR SALE

Casper, WY |

$13,063,500 USD

386-278-3262

GSM & Centurion anchored Portfolio

Casper, WY

OVERVIEW

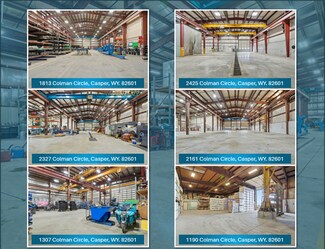

This rare industrial portfolio offers a compelling combination of stabilized income, credit tenancy, industrial outdoor storage (IOS), and substantial near-term development potential. The portfolio consists of six warehouse buildings situated on a total of 19 acres, strategically positioned to serve a variety of industrial needs.

Four of the six warehouses are currently leased, providing immediate cash flow, including two facilities leased to subsidiaries of nationally recognized tenants GMS and Centurion, underscoring the quality and durability of the rent roll. The remaining buildings offer value-add leasing opportunities, while the site’s layout and zoning support a wide range of industrial uses.

A key differentiator of this offering is the 20.05 acres of cleared, developable land, providing investors with exceptional flexibility for future expansion, build-to-suit development, or additional IOS-focused industrial facilities. The portfolio’s existing industrial outdoor storage capabilities further enhance tenant demand and rental premiums, aligning with one of the fastest-growing segments of the industrial real estate market.

This portfolio is ideally suited for investors seeking diversified industrial exposure, a blend of current income and upside, and a scalable footprint that can accommodate future growth. The combination of leased assets, national tenants, IOS functionality, and significant excess land positions this offering as a highly attractive long-term industrial investment.

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

386-278-3262

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

386-278-3262

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.