___ - Day Care Center FOR SALE

Diamond Bar, CA 91765 |

$5,350,000 USD

760-593-7653

___

Diamond Bar, CA 91765

HIGHLIGHTS

- Absolute NNN lease with corporate-backed tenancy and zero landlord responsibilities.

- Purpose-built educational facility with high license capacity and strong replacement value.

- Secure, predictable cash flow with built-in annual rent increases and renewal options.

- Prime Southern California corridor with high barriers to entry and affluent demographics.

- Institutional-grade investment ideal for 1031 exchange and passive income seekers.

- Long-standing national operator with proven stability and strong enrollment demand.

OVERVIEW

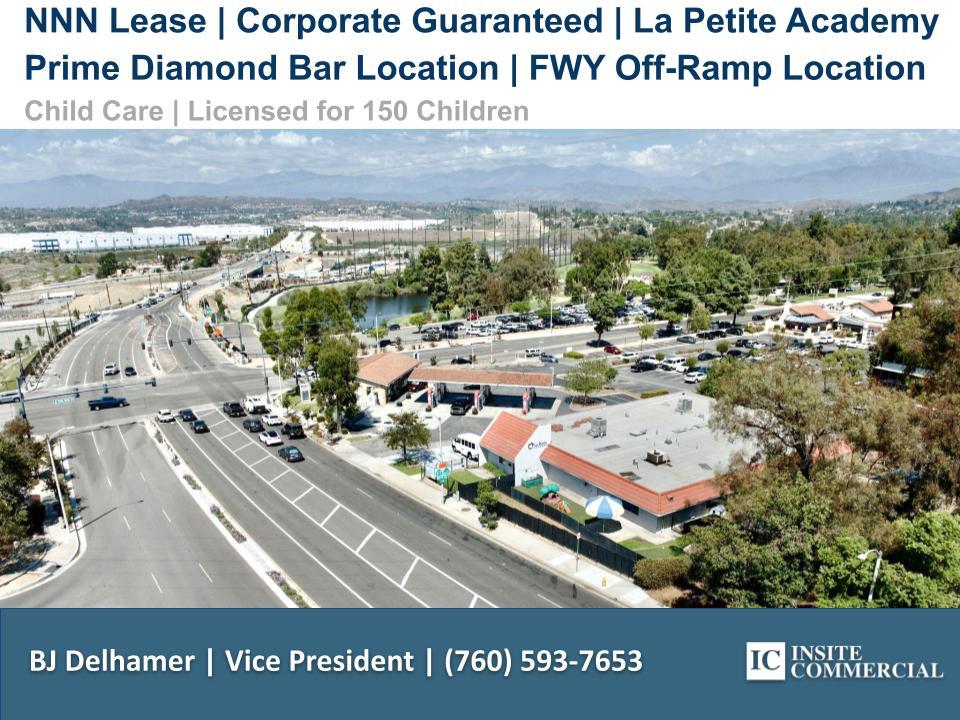

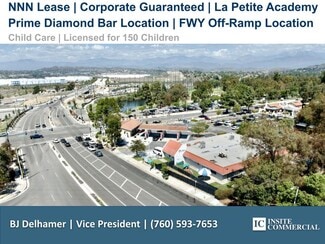

This offering presents a rare opportunity to acquire a fully leased child care property with corporate-backed tenancy in a strong Southern California location. The property is positioned in a dense, land-constrained corridor with excellent demographics, limited educational supply, and long-term demand drivers that continue to fuel interest from both institutional investors and 1031 exchange buyers.

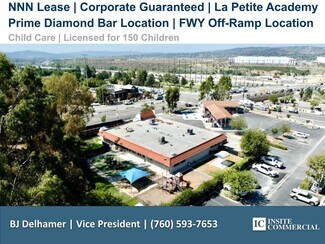

The facility itself consists of a purpose-built educational building of over 7,500 square feet situated on a parcel approaching one acre. The improvements include well-maintained classrooms, administrative areas, secure entry points, dedicated play yards, and ample onsite parking. The site is licensed for a substantial student capacity, providing both operational efficiency and significant replacement value.

The tenant is a nationally recognized operator with hundreds of locations across the United States and a long history of financial stability. The lease is structured on an absolute triple-net basis, providing passive ownership benefits with minimal landlord responsibilities. Current rental income grows annually through contractual rent escalations, and the tenant maintains options to extend beyond the initial term. This structure ensures predictable cash flow and offers a compelling hedge against inflation.

The surrounding market features excellent fundamentals. The property sits within an affluent residential community characterized by strong household incomes, dual-working parent households, and consistent demand for quality early childhood education. The area benefits from limited available land, creating a high barrier to entry for new competition. In addition, the location offers convenient access to regional freeways, employment centers, and higher-education institutions that support ongoing enrollment stability.

Investment highlights include:

* Absolute Triple-Net Lease Structure – Passive income stream with virtually no landlord obligations.

* Corporate-Backed Tenancy – Lease guaranteed by a leading national operator with extensive scale and resources.

* Strong Rent Growth – Built-in annual rental increases with upside through renewal options.

* Institutional-Grade Demographics – High population density, strong household incomes, and long-term demand for child care services.

* Purpose-Built Facility – Modern, efficient floor plan with classrooms, playgrounds, and supporting infrastructure tailored for child care.

* High License Capacity – Substantial student licensing in place, creating strong underlying real estate value.

* Barriers to Entry – Land-constrained corridor with limited alternative supply.

* 1031 Exchange Appeal – Stable, long-term investment with potential tax-deferred benefits.

This offering is well suited for both institutional investors seeking secure cash flow and private buyers seeking to complete a 1031 exchange into a passive, management-free asset. With limited comparable opportunities available in Southern California, this child care property represents a best-in-class investment that blends operational stability with underlying real estate fundamentals.

Interested parties are encouraged to execute the Confidentiality Agreement (NDA) to receive the full Offering Memorandum, financial details, lease documents, and tenant background. The offering remains active at this time.

FOR SALE DETAILS

PRICE

$5,350,000 USD

PRICE/SF

$710 USD /SF

CAP RATE

5.89%

% LEASED

-

TENANCY

Single

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Corp Backed Child Care | Absolute NNN Lease

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Day Care Center

ADD'L SUBTYPES

Freestanding

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1987

SPRINKLERS

-

PARKING SPACES

15

LAND DETAILS

LAND ACRES

0.84 AC

LAND SF

36,731 SF

ZONING

LCC4*

APN/PARCEL ID

8717-025-053

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

760-593-7653

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

760-593-7653

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.