917 S Edith Ave - Apartments FOR SALE

Alhambra, CA 91803 |

$2,900,000 USD

917 S Edith Ave

Alhambra, CA 91803

OVERVIEW

10-Unit Multifamily Investment in Prime Alhambra Location

Strategically positioned in the core of Alhambra, California, this 10-unit multifamily property presents a compelling opportunity for investors seeking a stable and well-located asset within one of Los Angeles County’s most resilient rental submarkets.

Alhambra continues to demonstrate strong rental fundamentals, with consistent occupancy rates, low vacancy levels, and a diversified tenant base driven by proximity to major employment and educational hubs such as Cal State LA, Downtown Los Angeles, and Pasadena. The city’s blend of established neighborhoods, cultural amenities, and robust local services supports steady rent growth and long-term tenant retention.

The property offers 19 total bedrooms and 10 bathrooms across its unit mix, supported by covered carport parking and an on-site laundry facility that provides additional income potential. The asset’s central location—near shopping corridors, public transit, and major freeways—enhances its desirability and accessibility for tenants.

Surrounded by a well-developed residential and commercial environment, this property represents a rare opportunity to acquire a cash-flowing asset in a high-demand market with long-term appreciation potential. Investors can benefit from Alhambra’s strong rental demand, limited multifamily supply pipeline, and proximity to major regional economic centers in the San Gabriel Valley and Greater Los Angeles area.

Why This Property Offers Value

-High occupancy / low vacancy risk – With a reported vacancy rate of ~2.9 % for multifamily in Alhambra, the rental market is demonstrating strong tenant demand.

-Upside potential via ancillary income – Covered carports and on-site laundry present additional revenue streams that enhance overall asset yield.

-Commuter & institutional demand drivers – The location benefits from proximity to Cal State LA, the greater Pasadena and Downtown Los Angeles employment bases, and established transit/freeway connectivity, supporting both resident retention and rental stability.

-Limited new supply – The relatively modest pipeline of new multifamily inventory in the San Gabriel Valley limits competitive pressure, supporting renter-demand fundamentals and potential rental growth.

-Market-led rent levels – With prevailing rents at or above $2,400/month in Alhambra and steady, albeit modest, growth in asking rents, income stability and modest growth potential coexist.

FOR SALE DETAILS

PRICE

$2,900,000 USD

PRICE/SF

$368 USD /SF

# OF UNITS

10

PRICE/UNIT

$290,000

CAP RATE

5.07%

% LEASED

100%

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

2

YEAR BUILT

1962

PARKING SPACES

10

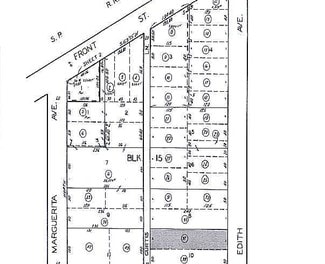

LAND DETAILS

LAND ACRES

0.28 AC

LAND SF

12,001 SF

ZONING

RPD, Alhambra

APN/PARCEL ID

5350-021-037

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.