8761 HWY 78 W - Apartments FOR SALE

Okeechobee, FL 34974 |

$7,350,000 USD

954-923-2325

8761 HWY 78 W

Okeechobee, FL 34974

HIGHLIGHTS

- Value Add | Operating below market rents, the communities provide potential for increased revenue through lease-up and rental rate realignment.

- Affordable Housing Demand offer a low-barrier entry to homeownership or rental, making them increasingly attractive in markets like Okeechobee

- Two Contiguous Parks 123 Pads

- The Dew Drop Mobile Home Park sits on 3.9 acres and contains 57 pads with one folio

- Okeechobee Lake Mobile RV Park contains 66 pads

OVERVIEW

Value Add - Owner Financing Available. Please review the attached Offer Memorandum

Investment Overview

The offering presents an exceptional opportunity to acquire two contiguous mobile home and RV parks—Dew Drop RV Park and Okeechobee Lake RV Park—positioned on a combined 10.2 acres with canal frontage providing direct access to Lake Okeechobee, one of Florida’s most iconic natural landmarks.

Property Highlights

Dew Drop RV Park

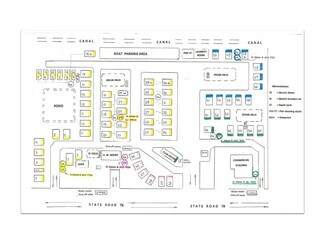

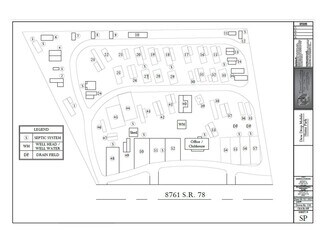

Located at 8761 Highway 78 West, Dew Drop was originally developed in 1988 and spans 3.9 acres featuring 57 well-maintained, rent-only pads. The park is thoughtfully designed with dual access points, paved interior roadways, and sub-metered public water with septic infrastructure in place. Tenants are billed for their pro-rata share of electricity, ensuring efficient operational cost recovery. The property’s layout and mature landscaping reflect a well-established, stabilized community environment.

Okeechobee Lake RV Park

Situated at 9851 Highway 78 West, Okeechobee Lake RV Park encompasses 66 rent-only pads and offers residents an enhanced living experience with a clubhouse, freestanding bathroom and shower facility, and a utility room for on-site convenience. Tenants are billed for water as a pass-through expense, supporting consistent NOI performance.

Adding to its appeal, the property includes a 6,743± SF commercial building fronting Highway 78—formerly a restaurant—offering tremendous value-add potential for commercial or mixed-use redevelopment, capitalizing on the site’s visibility and frontage.

Location & Market Position

The parks are strategically located just six miles (approximately 5–10 minutes) from Downtown Okeechobee, providing residents quick access to local shopping, dining, and essential services. This proximity delivers a distinct competitive edge over many comparable parks in the region, which are often located farther from the city’s core.

Current lot rents of $450–$500 per month remain below the prevailing market average of approximately $550 per month, offering immediate rent-growth potential and meaningful upside in cash flow through incremental adjustments.

FOR SALE DETAILS

PRICE

$7,350,000 USD

PRICE/SF

$237 USD /SF

# OF UNITS

123

PRICE/UNIT

$59,756

CAP RATE

5%

% LEASED

84%

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Dew Drop & Okeechobee Lake Mobile Home Parks

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Garden

PROPERTY SUBTYPE

Apartments

ADD'L SUBTYPES

Manufactured Housing/Mobile Housing

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1988

PARKING SPACES

-

LAND DETAILS

LAND ACRES

4.26 AC

LAND SF

185,501 SF

ZONING

-

APN/PARCEL ID

R1-17-38-35-0A00-00005-0000

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

954-923-2325

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

954-923-2325

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.