$5,750,000 USD

213-785-4459

7425 S Main St

Los Angeles, CA 90003

Canndu/Avalon Gardens

OVERVIEW

Stand-alone commercial property located at the signalized intersection, offering strong visibility and consistent daily traffic. The site features a single-story building with approximately 5,141 SF of gross leasable area, situated on a 12,408 SF lot, allowing for efficient layout, customer access, and parking functionality.

The building was constructed in 2016 and is in good operating condition. Designed for commercial use, the property supports high-utility operations and is well suited for laundromat use or other neighborhood-serving retail uses permitted under C2 zoning.

The one-floor configuration provides full operational efficiency with a full 5,141 SF typical floor, minimizing wasted space and maximizing revenue-generating square footage. The property benefits from its positioning in a dense residential area, driving steady foot traffic and repeat customer demand.

This is an ideal owner-user or investment opportunity, combining modern construction, functional layout, and a strong urban infill location with long-term upside.

Property Highlights

• Approx. 5,141 SF building

• 12,408 SF land area

• Built in 2016

• Single-story commercial structure

• C2 zoning

• High-traffic corner location

• Strong surrounding residential density

Tax Advantage – 2026 Coin Laundromat Purchase (Big Beautiful Bill Benefit)

Buyers acquiring this coin laundromat in 2026 may benefit from accelerated depreciation provisions under the Big Beautiful Bill, which preserve and enhance Section 179 and bonus depreciation treatment for qualifying equipment. Commercial laundry equipment typically qualifies as tangible personal property, allowing buyers to expense a significant portion of the purchase price in the first year rather than depreciating it over a long schedule.

This can result in:

• Substantial first-year tax write-offs

• Improved after-tax cash flow

• Lower effective cost of acquisition

• Strong alignment with high-cash-flow businesses like laundromats

FOR SALE DETAILS

PRICE

$5,750,000 USD

PRICE/SF

$1,118 USD /SF

CAP RATE

Request Cap Rate

% LEASED

-

TENANCY

Single

SALE TYPE

Owner User

BUILDING DETAILS

PROPERTY NAME

Sount Main St. Coin Laundromat

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Freestanding

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

2016

SPRINKLERS

-

PARKING SPACES

-

LAND DETAILS

LAND ACRES

0.28 AC

LAND SF

12,408 SF

ZONING

C2

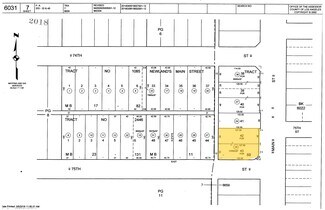

APN/PARCEL ID

6031-007-039

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

213-785-4459

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

213-785-4459

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.