709 S Commercial St - Auto Repair FOR SALE

Harrisburg, IL 62946 |

$3,220,000 USD

310-261-8428

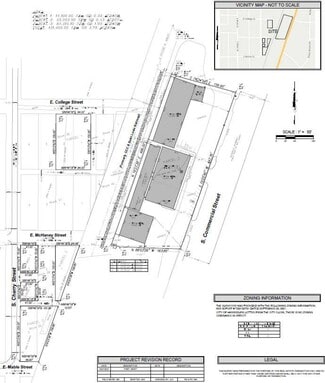

709 S Commercial St

Harrisburg, IL 62946

OVERVIEW

DWG Capital Group presents a value-add industrial credit opportunity in Harrisburg, IL. The ±34,621 SF facility, formerly corporately guaranteed by Goodyear (S&P: BB-), offers entry at $93/SF, well below replacement cost. With a pro-forma NOI of $193,200 and implied rent of $5.58/SF NNN, the property is competitively priced, defensible on re-tenanting, and positioned for future upside.

Investment Highlights

Attractive Basis: $93/SF, significantly below replacement cost

Credit Legacy: Former Goodyear-backed tenancy (S&P: BB-)

Below Market Rent: $5.58/SF NNN provides defensible entry economics

Pro-Forma Yield: 6.00% achievable at market rents

Flexible Strategies: re-tenant with regional/national credit users; sell to an owner/user; redevelop or reposition

1031 Appeal: Ideal exchange size and structure

About DWG Capital Group: DWG Capital Group is a seasoned institutional advisory team with more than $2 billion in closed transactions and over 15,000 units executed nationwide. The firm has completed over 421 state-side closings, specializing in commercial, residential, development, debt, and equity advisory at an institutional standard.

The leadership team — Judd Dunning, Hugh Gehrke, and Mike Paytonjian — brings decades of national brokerage, private equity, and capital markets experience, with a foundation built under Newmark Capital Markets before launching DWG’s independent platform.

Market & Location

Strategic tri-state hub serving Illinois, Kentucky, and Indiana

Direct interstate and airport access

Carbondale–Marion market with rent growth, low vacancy, limited supply

Cost-competitive labor base supporting tenant operations

Tenant / Credit Profile – The Goodyear Tire & Rubber Company (S&P: BB-)

Q1 2025 Net Sales: $4.3 billion

Net Income: $115 million

Segment Operating Income: $195 million

Transformation Plan: $200 million in portfolio and efficiency benefits

Credit Rating: BB- (stable); Debt/EBITDA below 5x; free cash flow to debt 5%+

Global Footprint: 72,000 employees, 57 facilities in 23 countries, two innovation centers (Akron, OH and Luxembourg)

Market Rent & Comparable Positioning

Regional Flex/Industrial Average: $6.00–$7.50/SF NNN

Retail Corridor Benchmarks: $10.00–$15.00/SF NNN in Illinois secondary markets

In-Place Rent: $5.58/SF NNN – defensible entry with upside

FOR SALE DETAILS

PRICE

$3,220,000 USD

PRICE/SF

$93 USD /SF

CAP RATE

6%

% LEASED

-

TENANCY

Single

SALE TYPE

Investment Or Owner User

BUILDING DETAILS

PROPERTY NAME

Rabin Tire & Auto Service

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Auto Repair

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1983

SPRINKLERS

-

PARKING SPACES

19

LAND DETAILS

LAND ACRES

2.78 AC

LAND SF

121,097 SF

ZONING

-

APN/PARCEL ID

06-2-503-04

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

310-261-8428

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

310-261-8428

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.