703 S Cedar Ridge Dr - Medical FOR SALE

Duncanville, TX 75137 |

$2,772,771 USD

818-484-1658

703 S Cedar Ridge Dr

Duncanville, TX 75137

HIGHLIGHTS

- Established Market Leader – In 2022, Charlesbank Capital Partners acquired ABC in a transaction valuing the company at $840 million.

- Long-Term NNN Lease – The tenant signed an original ten-year lease in 2023, demonstrating its long-term commitment to the location.

- Inflation-Protected Cash Flow – The lease features 3% annual rent increases, offering investors built-in income growth.

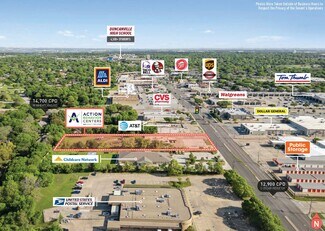

- Target Location – Strategic Childcare Positioning – Childcare Network, a well-established childcare and after-school program.

OVERVIEW

50/50 Commission Split.

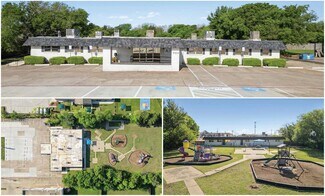

Matthews™ Healthcare Division is proud to present the exclusive opportunity to acquire a premier healthcare investment leased to Action Behavior Centers (ABC), one of the nation’s largest and most established providers of Applied Behavioral Analysis (ABA) therapy. This offering consists of a 100% fee simple interest in an ±8,316 SF facility situated on a 2-acre parcel in Duncanville, Texas; part of the Dallas–Fort Worth metroplex, one of the largest and fastest-growing MSAs in the United States. The tenant benefits from over seven years of remaining primary term with two additional five-year renewal options, and the lease features 3% annual rental escalations, providing investors with durable cash flow and a built-in hedge against inflation.

The property is leased on a NNN basis with a 3% escalators and 7+ years of remaining term and is strategically located in an affluent DFW submarket with average household incomes over $100,000. Positioned around one mile from Duncanville High School, one of the largest high schools in Texas, the site is surrounded by a strong family-oriented demographic, supporting sustained demand and a deep potential patient base.

In 2022, Charlesbank Capital Partners acquired ABC in a transaction valuing the company at $840 million. Since that acquisition, ABC has continued its aggressive growth trajectory and now operates over 300 clinics across multiple states, including Texas, Arizona, Colorado, Illinois, North Carolina, and Minnesota.

With the global autism therapy market projected to exceed $6 billion by 2030, this investment represents a rare opportunity to secure long-term, inflation-protected income while gaining exposure to a rapidly expanding and mission-critical sector of healthcare real estate.

Broker of Record

Patrick Graham

License # 9005919 (TX)

Matthews Real Estate Investment Services, Inc

8300 Douglas Ave., Ste. 750, Dallas, TX 75225

(866) 889-0550

FOR SALE DETAILS

PRICE

$2,772,771 USD

PRICE/SF

$333 USD /SF

CAP RATE

7%

% LEASED

-

TENANCY

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Action Behavior Centers | NNN Lease | 7% Cap

PROPERTY TYPE

Office

PROPERTY SUBTYPE

Medical

ADD'L SUBTYPES

Freestanding, Storefront Retail/Office

TOTAL BUILDING SIZE

-

STORIES

1

BUILDING CLASS

B

YEAR BUILT

1975

SPRINKLERS

-

PARKING SPACES

-

LAND DETAILS

LAND ACRES

2 AC

LAND SF

87,120 SF

ZONING

-

APN/PARCEL ID

22073500000030000

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

818-484-1658

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

818-484-1658

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.