$450,000 USD

312-730-2029

6933 S Washtenaw Ave

Chicago, IL 60629

Marquette Park

HIGHLIGHTS

- Fully rehabbed in 2023 with new roof, HVAC, plumbing, electrical, windows, façades, and landscaping upgrades.

- 4,503 SF GBA with 4,351 SF NRA delivers highly efficient layout maximizing long-term income stability.

- Institutional-style systems with new forced-air HVAC, separate gas/electric meters, and new water systems.

- Two rehabbed 2BR units with stainless kitchens; lower level offers 1,018 SF future unit at ~$1,350/month.

- Income upside via $75/month parking leases and potential rent growth to $1,700/month per renovated unit.

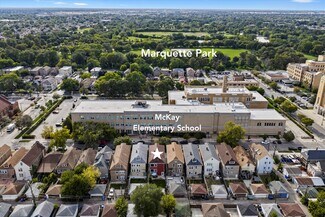

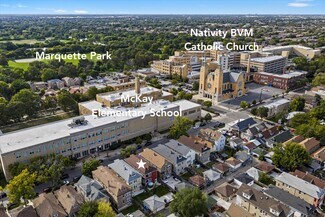

- Prime Chicago Lawn location across McKay Elementary, near Marquette Park, CTA transit, retail, and Midway.

OVERVIEW

6933 S Washtenaw Ave | Chicago, IL 60629. Three-Unit Multifamily | Fully Rehabilitated | Turnkey Cash Flow?(Chicago Lawn / Lithuanian Plaza / Marquette Park)

Building Overview:

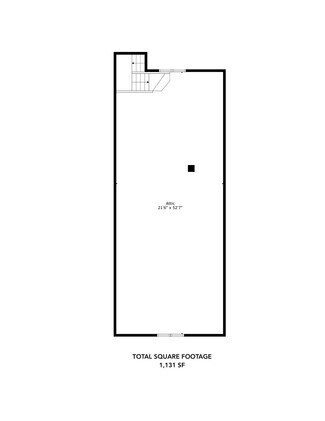

The property encompasses a Gross Building Area (GBA) of 4,503 SF and a Net Rentable Area (NRA) of 4,351 SF, offering a highly efficient layout with minimal common space. This strong ratio of rentable-to-gross square footage underscores the asset’s functionality and maximization of income-producing space, an important factor for investors focused on long-term cash flow stability.

Investment Highlights:

This turnkey 3-unit brick multifamily has been fully rehabbed with comprehensive 2023 capital upgrades, including improvements to the envelope, MEPs, and site. The building features institutional-style systems with forced-air HVAC (hot/cold) in all units. Clean metering includes 3 separate gas meters and 4 electric meters, including a house meter. Parking provides 3 surface spaces, currently vacant and not leased, while laundry is supported by a communal coin-operated washer/dryer that is owner-owned. Zoning is RS-3 (buyer to verify). The location is directly across from McKay Elementary (CPS) and one block from the Marquette Park Golf Course and Driving Range.

Capital Expenses (2023 Unless Noted):

Major upgrades include full replacement of all furnaces, compressors, water tanks, and boilers in 2023. Plumbing has been fully replaced with copper water lines, a cast-iron main, and a 2? PVC range line. Electrical systems were also fully replaced in 2023. A new roof was installed, along with window replacements on the first and second floors, a refreshed front façade, and side façades recently performed. Site and landscaping improvements include new hardscape and turf grass installation.

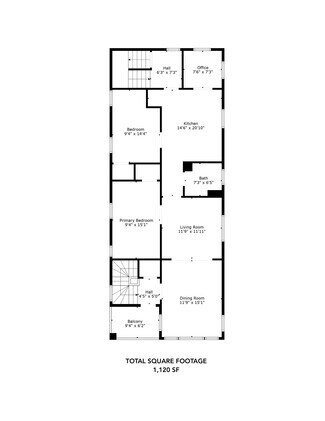

Unit Program & Interiors:

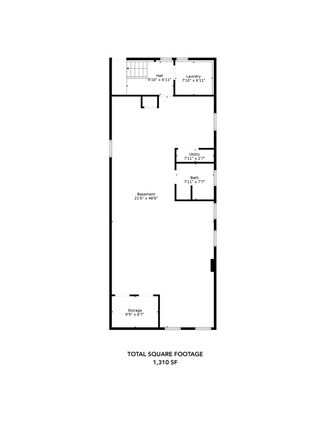

Unit 1 (First Floor) offers 2 bedrooms with closets, separate living and dining rooms, and a rehabbed kitchen with stainless appliances and a ~7-ft island, with forced hot/cold HVAC. Unit 2 (Second Floor) mirrors this layout with 2 bedrooms, separate living and dining rooms, a rehabbed kitchen with stainless appliances and ~7-ft island, forced hot/cold HVAC, and a large balcony. The lower level has dedicated HVAC, compressor, and water tank/meters (2023). It is currently unfinished but presents an opportunity for a future finished unit with forced hot/cold air and projected rent of approximately $1,350/month for the 1,018 SF space.

Utilities, Meters & Site:

Gas service is metered separately for each unit (3 meters total). Electric service includes 4 meters, one for each unit plus a house meter. Water and hot water systems were fully replaced in 2023, with the lower level supported by a dedicated tank. Parking consists of 3 outdoor spaces, not currently leased, which could generate additional annual income at $75 per vehicle. Laundry service is provided by an owner-owned coin-operated washer/dryer.

Location & Connectivity:

The property is located in the Chicago Lawn / Marquette Park submarket on Chicago’s Southwest Side. Transit access includes multiple CTA bus routes (#67, #63, #49, #94) with Orange Line rail connections at Western, Kedzie, and Midway stations, providing approximately 20–25 minutes from Midway to the Loop. Chicago Midway International Airport is nearby. Recreation amenities include Marquette Park with its lagoon, 9-hole golf course, and driving range.

Retail, Grocers & Daily Needs:

Nearby retail options include Target at 7100 S Cicero Ave (with CVS Pharmacy), Pete’s Fresh Market at 5838 S Pulaski Rd, Jewel-Osco at 5320–5324 S Pulaski Rd, ALDI at 6025 S Western Ave, and Food 4 Less at 7030 S Ashland Ave.

Neighborhood Demand & Rent Positioning:

As of July 31, 2025, Chicago citywide asking rent (Zillow ZORI) is $2,331, reflecting a 6.3% year-over-year increase. Within the submarket, rehabbed 2-bedroom units are asking between $1,350 and $1,700. The subject property’s current rents of $1,500 and $1,575 are competitive within this range.

Forward-Looking Rent Context:

Nationally, Zillow reports July 2025 rents up 2.6% year-over-year, with multifamily rents up 2.1% and forecast growth of approximately 1% for 2025. Apartment List reports Chicago median rent up around 4% year-over-year. This positions neighborhood rents as stable-to-slightly rising, with upside for renovated units near retail and transit.

Submarket & Pipeline Notes:

The nearby Ford City Mall area is under review for a proposed $150M industrial-campus redevelopment totaling approximately 913,000 SF. The 79th Street Corridor is also undergoing city-led revitalization, with retail upgrades and small-business activity supporting local growth.

Education & Community:

Directly across from the property is McKay Elementary School (CPS). The community is further supported by multiple houses of worship serving as local anchors.

Income Potential:

Rehabbing the lower level may generate approximately $1,300 per month, with new HVAC for forced air cooling and heating and a new water tank already in place. Additionally, new leases may be increased to $1,700 per month in line with prevailing rents for rehabbed units in the area.

FOR SALE DETAILS

PRICE

$450,000 USD

PRICE/SF

$100 USD /SF

# OF UNITS

3

PRICE/UNIT

$150,000

CAP RATE

Request Cap Rate

% LEASED

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

6933 S Washtenaw Ave, Chicago, IL

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

ADD'L SUBTYPES

Apartments

TOTAL BUILDING SIZE

-

STORIES

3

YEAR BUILT

1928

PARKING SPACES

3

LAND DETAILS

LAND ACRES

0.09 AC

LAND SF

3,750 SF

ZONING

RS-3

APN/PARCEL ID

19-24-415-017-0000

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

312-730-2029

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

312-730-2029

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.