6837 Highway 126 N - Manufacturing FOR SALE

Midway, AR 72651 |

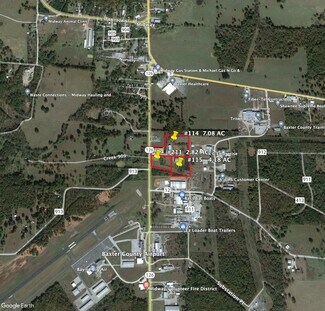

6837 Highway 126 N

Midway, AR 72651

FOR SALE DETAILS

PRICE

-

CAP RATE

-

% LEASED

-

TENANCY

-

BUILDING DETAILS

PROPERTY NAME

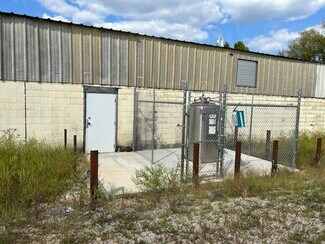

EZ Loader/Uniforce Manufacturing

PROPERTY TYPE

Industrial

PROPERTY SUBTYPE

Manufacturing

TOTAL BUILDING SIZE

-

STORIES

2

YEAR BUILT

2000

UTILITIES

-

CLEAR CEILING HT

15 Ft

DOCKS

1

DRIVE INS

3

PARKING SPACES

-

LAND DETAILS

LAND ACRES

-

LAND SF

-

ZONING

-

APN/PARCEL ID

001-09394-114