$3,999,999 USD

813-335-0333

6700 22nd Ave N

Saint Petersburg, FL 33710

Crossroads Area

OVERVIEW

Rare NNN investment with Florida Blue (Blue Cross Blue Shield) as the tenant! Their credit rating with AM Best is A+ (Superior) and their long-term Credit Rating is "aa-" (Superior). S&P Global affirmed an 'A+' rating for Blue Cross & Blue Shield of Florida Inc. (BCBSFL)in 2019. Very few Florida Blue NNN investment real estate deals hit the market & I believe this is the only one available in the country currently.

The building is currently occupied by Charles Schwab & Co. Schwab’s lease expires Feb. 1st, 2026, and they will relocate to a different location in St Petersburg.

Florida Blue (Blue Cross and Blue Shield) has signed a 10-year lease of the property commencing upon the departure of Schwab in February 2026. The Florida Blue lease has 2 renewal options of five (5) years each (the "Renewal Periods"), with rental rate in the amount of 10% every five (5) years including each Renewal Period.

Florida Blue’s lease includes a period of time for buildout. The Landlord is also providing a rent abatement period in lieu of a tenant improvement allowance. The clauses for these provisions read as follows:

“Fixed Rent shall commence on the earlier of: (a) 180 days after receipt of Tenant's building permits, (b) 150 days from the Delivery of Possession Date; or (c) the date Tenant opens for business (the "Rent Commencement Date").”

“TENANT IMPROVEMENT ALLOWANCE: Commencing on the Rent Commencement Date, Landlord shall provide Tenant a 9-month free Fixed Rent period ("Rent Abatement Period") in lieu of a Tenant Improvement Allowance. During the Rent Abatement Period, Tenant shall pay all Additional Rent, including, but not limited to, all maintenance charges, Taxes, Insurance required of Tenant by this Lease, and utilities.”

The Florida Blue rent for years 1-5 will be $162, 855 ($45NNN). Tenant is responsible for all expenses including property tax, insurance, and maintenance. The building is in absolutely perfect condition.

At closing, Seller will compensate Buyer for base rent during the 9 months free rent period so that Buyer is assured a full 10-year initial term by Tenant (plus the remaining term of the Schwab lease)

The lease is executed by “BLUE CROSS AND BLUE SHIELD OF FLORIDA, INC., a Florida corporation d/b/a Florida Blue ("Tenant")”. The lease is NNN making this an ideal, management-free investment opportunity for a passive investor. Founded in 1929, Blue Cross Blue Shield is a leading health insurance provider and helps cover roughly 115 million Americans

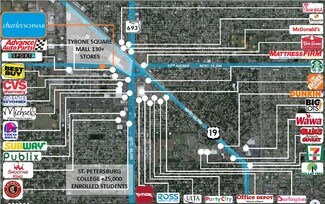

The Tyrone submarket is a high barrier of entry submarket with very little inventory for sale or lease. The site is directly across from Tyrone Square Mall and Dick's Sporting Goods. Other big box retailers in the immediate area beyond Tyrone Mall include Home Depot, Burlington, Office Depot, Publix, Michael’s, Beall’s, TJ Maxx & Marshalls, among others. The Tyrone submarket is the heart of retail shopping in St Petersburg. There are over 250,000 + residents within a 5-mile radius. The "Schwab” building is 3,619 SF and has always been operated by a national bank or a brokerage house and impeccably maintained by their maintenance departments. The lot size is .92 acre and is Zoned CG. There are 43 parking spaces, a large grandfathered in pylon sign and full ingress/egress with 175’ ft of frontage on 22nd Ave N. with excellent visibility from both directions. This property is in pristine condition and the perfect investment for a passive investor. And remember, Florida has No State Income Tax. At this time, Seller is not offering a co-broke. NOTE: DUE TO SCAMMERS, I WILL NOT RESPOND TO EMAILS, IF YOU HAVE ANY ADDITIONAL QUESTIONS, I'M A PHONE CALL AWAY AT 813-335-0333.

FOR SALE DETAILS

PRICE

$3,999,999 USD

PRICE/SF

$1,105 USD /SF

CAP RATE

Request Cap Rate

% LEASED

-

TENANCY

Single

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Charles Schwab Branch

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Bank

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1981

SPRINKLERS

-

PARKING SPACES

-

LAND DETAILS

LAND ACRES

0.92 AC

LAND SF

40,075 SF

ZONING

CG, St Pete

APN/PARCEL ID

18-31-16-19751-001-0010

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

813-335-0333

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

813-335-0333

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.