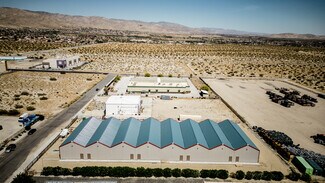

65253 San Jacinto Ln - Warehouse FOR SALE

Desert Hot Springs, CA 92240 |

$5,700,000 USD

714-574-3540

65253 San Jacinto Ln

Desert Hot Springs, CA 92240

OVERVIEW

Exceptional Investment Opportunity. Newly Constructed Industrial Facility Designed for the Cultivation Industry. The Property is Situated on a Secure 1.26 Acre Lot Featuring a Total of 8 Room 30x80 sqft Ideal for General Industrial Applications, the 20,160 sqft Facility Offers Flexible Space for Custom Growth Operations. Seller is willing to negotiate equipment to complete manufacturing. Seller Carry for Buyers Available.

please review below details:

Business Opportunity/Proforma

• The cannabis market is rapidly expanding and coming back in a big way, with increasing legalization and acceptance. Our facility addresses the need for consistent, high-quality cannabis, providing a reliable supply to meet market demand.

• Business Model

• This facility Designed to generate revenue by cultivating and selling cannabis in the medical field and a variety of other fields. Our facility will potentially produce 3,780 pounds per quarter, totaling 15,120 pounds annually. With an average selling price of $1,600 per pound, we project an annual revenue of $24.2 million.

•

• Introduction

• Our cannabis cultivation facility aims to capitalize on the growing demand for high-quality cannabis by leveraging advanced cultivation techniques and efficient management. With a robust infrastructure of 1080 lights and a projected annual revenue of $24.2 million, we are positioned for significant growth in this burgeoning market.

•

• Financial Projections

1. Projected Revenue

• Number of Lights: 1080

• Yield per Light per Harvest: 3.5 pounds

• Total Yield per Harvest: 1080 lights×3.5 pounds/light=3780 pounds1080 \, \text{lights} \times 3.5 \, \text{pounds/light} = 3780 \, \text{pounds}1080lights×3.5pounds/light=3780pounds

• Price per Pound: $1600

• Revenue per Harvest: 3780 pounds×$1600/pound=$6,048,0003780 \, \text{pounds} \times \$1600/\text{pound} = \$6,048,0003780pounds×$1600/pound=$6,048,000

• Number of Harvests per Year: 4

• Annual Revenue: $6,048,000×4=$24,192,000\$6,048,000 \times 4 = \$24,192,000$6,048,000×4=$24,192,000

• These calculations were based on 6 rooms, only not seven rooms which are currently available for production.

2. Operating Costs

Operating Cost Percentage: 35%

• Annual Operating Costs: 35%×$24,192,000=$8,467,20035\% \times \$24,192,000 = \$8,467,20035%×$24,192,000=$8,467,200

3. Gross Profit

• Annual Gross Profit: $24,192,000-$8,467,200=$15,724,800\$24,192,000 - \$8,467,200 = \$15,724,800$24,192,000-$8,467,200=$15,724,800

• Introduction

• Our cannabis cultivation facility aims to capitalize on the growing demand for high-quality cannabis by leveraging advanced cultivation techniques and efficient management. With a robust infrastructure of 1080 lights and a projected annual revenue of $24.2 million, we are positioned for significant growth in this burgeoning market.

• Business Opportunity

• The cannabis market is rapidly expanding, with increasing legalization and acceptance. Our facility addresses the need for consistent, high-quality cannabis, providing a reliable supply to meet market demand.

• Business Model

• We will generate revenue by cultivating and selling cannabis. Our facility will produce 3,780 pounds per quarter, totaling 15,120 pounds annually. With a selling average market price of $1,600 per pound, we project an annual revenue of $24.2 million.

Investment Terms

I offer two options for investment:

1. Debt Option: $3 million investment with a 10% annual return, secured by real estate.

2. Equity Option: $3 million investment for a 50% ownership stake, sharing profits equally.

3. Total Sale Price $5.900,000 with possible owner finance option available with 40% Down 60% Finance At 9.5% interest only for 5 years or more secured.

Exit Strategy

Investors can exit through IPO, acquisition, or buyout options

Investment Terms

We offer two options for investment:

4. Risk Analysis

Risk Factors

Key risks include market volatility, regulatory changes, and operational challenges.

Regulatory Risks

We mitigate regulatory risks by maintaining full compliance and staying informed about industry developments.

Market Risks

We address market risks through strategic planning, diversified revenue streams, and maintaining high product quality.

FOR SALE DETAILS

PRICE

$5,700,000 USD

PRICE/SF

$283 USD /SF

CAP RATE

Request Cap Rate

% LEASED

-

TENANCY

Single

SALE TYPE

Investment Or Owner User

BUILDING DETAILS

PROPERTY TYPE

Industrial

PROPERTY SUBTYPE

Warehouse

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

2021

UTILITIES

-

CLEAR CEILING HT

19 Ft

DOCKS

-

DRIVE INS

-

PARKING SPACES

-

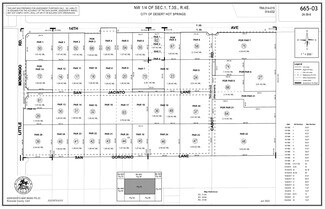

LAND DETAILS

LAND ACRES

1.26

LAND SF

54,886

ZONING

M

APN/PARCEL ID

665-030-036

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

714-574-3540

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

714-574-3540

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.