6036 Rainbow Heights Rd - Agricultural LAND FOR SALE

Fallbrook, CA 92028 | 4,356,000 SF

$5,999,000 USD

760-271-8837

6036 Rainbow Heights Rd

Fallbrook, CA 92028

OVERVIEW

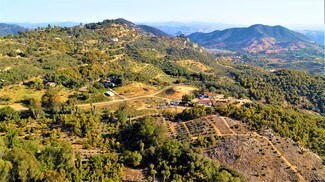

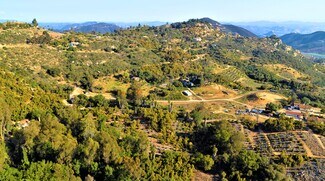

Rosa Sattoria represents a rare opportunity to acquire a 70-acre producing Hass avocado orchard in Southern California, supported by a proven operating history, integrated water resources, and additional ancillary income streams. The ranch has been continuously operated for decades, with financial history documented through IRS Schedule F filings (2016–2022), demonstrating consistent production and professional management.

Business Operations

The 2025 pro forma models 70 bearing acres at 10,000 lbs/acre, or approximately 700,000 pounds of fruit annually. At a base-case grower price of $1.44 per pound, projected gross revenues are $1.01 million, yielding a net operating income (NOI) of $99,400 after harvest, water, and cultural operating costs. Sensitivity scenarios show significant upside: a stronger price environment at $1.65/lb raises NOI to $245,700, while a high-yield scenario at 16,220 lbs/acre generates $683,707 in NOI.

Water & Infrastructure

Unlike many operations in California, Rosa Sattoria has historically not faced water constraints. Irrigation demand averages 3.0 acre-feet per acre, supplied 50/50 from on-site wells and purchased water connections. Current costs equate to approximately $4,543 per acre, or $318,000 annually, with well water significantly offsetting purchased supply. Non-water operating expenses, including fertilizers, chemicals, cultural labor, and management, total about $7,457 per acre.

Valuation

The attached pro forma models business value at a 10% cap rate for conservative planning. However, farmland and orchard investments in California typically trade at 3.8%–4.1% caps. Using a 4% midpoint, the orchard operations alone support a business valuation of approximately $2.5 million, exclusive of underlying acreage, improvements, a cell tower lease, and rental property income on-site. These additional components will be detailed separately with comparable sales data for land and real estate assets.

Key Highlights

70 bearing acres of Hass avocados, with proven yields and upside under favorable market conditions.

Integrated water security: on-site wells, desalination systems, and Rainbow Municipal Water District connection.

Operating costs aligned with industry benchmarks: $12,000 per acre, inclusive of all water and cultural costs.

Strong upside potential from pricing and yield improvements, as each sustained $0.10/lb increase in avocado prices adds ~$70,000 to NOI.

Long history of documented farm income and expenses (Schedule F 2016–2022) showing stable operation.

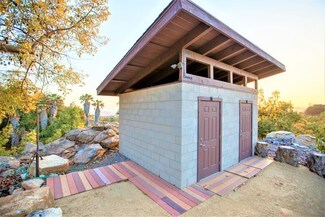

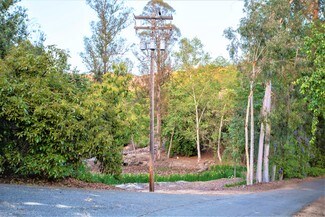

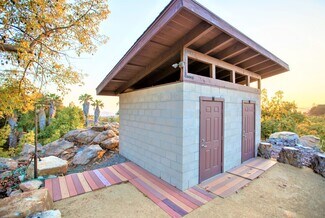

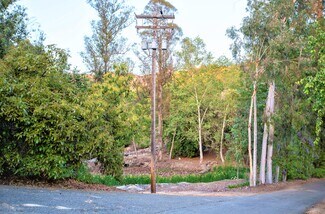

Additional cell tower and rental property income enhance total property returns beyond the orchard business itself.

Conclusion

Rosa Sattoria offers investors a stabilized California avocado orchard with secure water, upside income potential, and multiple asset layers beyond crop production. The business-only valuation of ~$2.5M under current market cap rates provides a strong foundation, with the total property value further supported by high-quality acreage, improvements, and ancillary income. A tour can be scheduled with advance notice to the owners.

FOR SALE DETAILS

PRICE

$5,999,000 USD

PRICE/ACRE

$59,990/AC

PRICE/SF

$1 USD /SF

# OF LOTS

-

LAND DETAILS

PROPERTY NAME

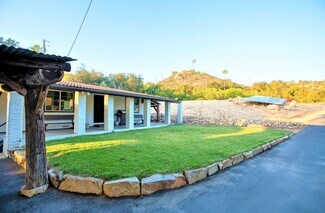

ROSA SATTORIA | 100 ACRE ESTATE SALE

PROPERTY TYPE

Land

PROPERTY SUBTYPE

Agricultural

LAND PROPOSED USE

Commercial, Mixed Use, Garden Center, Hold for Investment, Planned Unit Development, Single Family Development, Winery/Vineyard, Agricultural, Pasture/Ranch, Single Family Residence

LAND ACRES

100 AC

LAND SF

4,356,000 SF

OFFSITE IMPROVEMENTS

Sewer, Water, Electricity, Gas, Streets, Curb/Gutter/Sidewalk, Cable, Telephone, Irrigation

ZONING

Agriculture (A70)

APN/PARCEL ID

109-270-35,109-320-05,109-320-06,109-340-02,109-340-03

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

760-271-8837

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

760-271-8837

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.