214-738-4986

603 E Grayson St

San Antonio, TX 78208

Fort Sam Houston

HIGHLIGHTS

- Irreplaceable Location: Steps to the Pearl, the River Walk Museum Reach, and the BESA/Broadway East retail expansion.

- Multiple Exit Options: Hold as cash-flowing urban apartments, convert to corporate/furnished rentals, or pursue higher/better use via rezoning.

- Favorable Urban Demographics: Rising incomes and continued in-migration in the urban core; strong renter demand for character properties in walkable

- Nearby Catalysts: New luxury retail and mixed-use across from the Pearl; Jefferson Bank headquarters at Broadway & Grayson; Alamo Colleges District

- Surrounded by redeveloped properties: Restaurants, Bars, Office, Retail & Large Multi-Family

- Hold as Multi-Family, Rezone and Redevelop on your own Timeframe

OVERVIEW

5-unit multifamily property positioned on a prominent corner near the Pearl and the emerging Broadway East (BESA) district. Dense, walkable urban infill setting with immediate access to employment, dining, retail, and cultural destinations. Stable in-place income with meaningful mark-to-market upside and multiple value-creation paths: (1) renovate and re-tenant at market; (2) reposition to furnished/medium-term; (3) rezone commercial and redevelop to capitalize on adjacent high-end retail and office momentum.

Unit Mix:

· 603-1: 1 BR / 1 BA | 902 SF | $1,120/mo | Occupied

· 603-2: Efficiency | 350 SF | $875/mo | Occupied

· 605: 2 BR / 1.5 BA | 1,215 SF | $1,750/mo | Occupied

· 607: 2 BR / 1 BA | 1,171 SF | $1,450/mo | Occupied

· 609: 2 BR / 2 BA | 1,088 SF | $1,850/mo (proposed) | Vacant Shell Condition

In-Place Rents (Annualized): $62,340

Pro Forma Rents (Annualized at proposed market): $84,540

Annual Expenses: $30,279.24

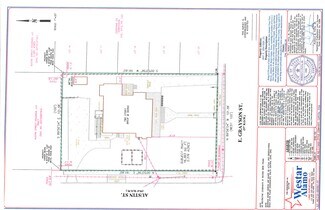

Site & Zoning

Site Area: 16,200 SF (±0.37 acres)

Zoning: RM-5

Redevelopment Potential (Buyer to verify):

· Small-scale infill apartments or mixed-use consistent with RM-5 zoning

· Potential assemblage with adjacent parcels for mid-rise or higher-density program

· Ground-floor retail or live-work along Grayson St frontage

· Relocate building to rear of lot to allow for new construction along frontage

Location Overview

Pearl & Museum Reach: Premier regional destination with culinary, retail, hospitality, and office uses anchored by the historic Pearl Brewery, Hotel Emma, and multiple Class-A office buildings. BESA / Broadway East: 15-acre multi-phase mixed-use district just east of the Pearl, set to deliver high-end retail and contemporary-to-luxury fashion with differentiated architecture. Employment Nodes: Jefferson Bank Headquarters at Broadway & Grayson; Alamo Colleges District HQ (2222 N Alamo St); Fort Sam Houston within short drive. Connectivity: Quick access to US-281, IH-35, and Broadway; minutes to downtown and the San Antonio International Airport.

Market Snapshot

· Urban Core Momentum: Ongoing infill projects and adaptive reuse continue to elevate rents and retail sales in Pearl-adjacent neighborhoods.

· Demand Drivers: White-collar employment growth, tourism/culinary destination traffic, and medical/education anchors.

· Rent Positioning: Character/heritage buildings with tasteful renovations command premium yields in this submarket relative to garden-style peers.

FOR SALE DETAILS

BUILDING DETAILS

PROPERTY NAME

603 E Grayson

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

ADD'L SUBTYPES

Storefront Retail/Residential, Apartments, Office/Residential

TOTAL BUILDING SIZE

-

STORIES

2

YEAR BUILT

1957

PARKING SPACES

-

LAND DETAILS

LAND ACRES

0.38 AC

LAND SF

16,466 SF

ZONING

RM-5

APN/PARCEL ID

00046-001-0050

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

214-738-4986

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

214-738-4986

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.