545-551 Woodward St - Apartments FOR SALE

San Marcos, CA 92069 |

$2,100,000 USD

760-230-8015

545-551 Woodward St

San Marcos, CA 92069

HIGHLIGHTS

- Four large townhome-style units (~1,325 SF each) across two duplexes; practical layouts and private entries.

- Two contiguous parcels with two duplexes on oversized lots (combined 18,800+ SF) provide scale and flexibility.

- Residential-style financing potential given the 4-unit configuration.

- Value-add upside: 1980s-era interiors largely original—renovate units and enhance exteriors/amenities to push rents toward market.

- Expansion potential: lot depth and layout create opportunities to evaluate ADUs/additions (buyer to verify).

- Location advantages: Less than 0.5 miles to Downtown San Marcos and CSUSM; quick access to SR-78 and regional job centers.

OVERVIEW

The offering at 545–547 and 549–551 Woodward Street in San Marcos presents a rare and highly strategic acquisition — two contiguous parcels, each improved with a duplex, o?ered together. As a combined opportunity, this allows an investor to secure residential-style ?nancing and unlock value from multiple angles.

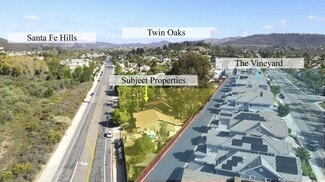

Located less than .4 miles from downtown San Marcos and the campus of California State University San Marcos, the property o?ers immediate access to the area’s strongest rental drivers: student demand, workforce housing growth, and retail/amenity expansion. Complementing this location is the adjacency to the well-established single-family community of Vineyard (San Marcos) (constructed in the mid-2000s), reinforcing the neighborhood’s trajectory of in?ll redevelopment, new home construction, and rising residential comparables.

- Two parcels, containing two duplexes on oversized lots: one parcel approx. 8,866 sq ft and the other 9,985 sq ft, for a combined lot area of over 18,800 sq ft — providing ample space not only for landscaping and outdoor amenities but also for future expansion or accessory dwelling unit (ADU) opportunities.

- Unit mix: two 2 bed/2 bath units and two 2 bed/1.5 bath units, all currently on month-to-month leases — o?ering ?exibility and immediate upside through unit-by-unit repositioning.

- Constructed in the early 1980s and largely in original condition, meaning the investor has the opportunity to execute a true value-add strategy: interior renovations, modern ?nishes, exterior upgrades, and amenity enhancements — all designed to push rents toward current market-level comparables.

- An investor is eligible for residential ?nancing, and with the oversized lots, there’s the potential to add ADUs

Because the assets are adjacent to the Vineyard community, the properties bene?t not only from their own scale and lot depth, but also from the positive halo e?ect of +$900K+ single-family homes nearby, reinforcing future value appreciation and repositioning potential.

Given the location, lot size, unit mix, ?nancing ?exibility, and repositioning potential, this o?ering is well-suited for

an investor seeking both near-term yield uplift and long-term appreciation in a stable, growth-oriented North County rental market.

FOR SALE DETAILS

PRICE

$2,100,000 USD

PRICE/SF

$396 USD /SF

# OF UNITS

4

PRICE/UNIT

$525,000

CAP RATE

4.2%

% LEASED

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1982

PARKING SPACES

4

LAND DETAILS

LAND ACRES

0.44 AC

LAND SF

19,166 SF

ZONING

R-2

APN/PARCEL ID

218-161-51-00,218-161-52-00

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

760-230-8015

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

760-230-8015

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.