- SEARCH FOR RENTCommercial SpaceOffice SpaceRetail SpaceWarehousesFlex Space

- SEARCH FOR SALEOffice SpaceRetail SpaceApartment BuildingsWarehousesHotelsCommercial Space

This Property is no longer advertised on Showcase.com.

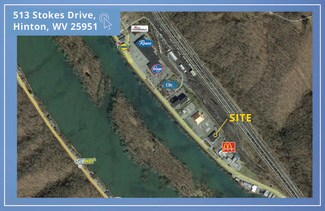

513 Stokes Dr - Drug Store FOR SALE

Hinton, WV 25951 |

513 Stokes Dr

Hinton, WV 25951

FOR SALE DETAILS

PRICE

-

PRICE/SF

-

CAP RATE

-

% LEASED

-

TENANCY

-

STATUS

Existing

SALE TYPE

SALE CONDITIONS

NET LEASE INVESTMENT

ON GROUND LEASE

COMMISSION SPLIT

%

BUILDING DETAILS

PROPERTY NAME

Walgreens

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Drug Store

ADD'L SUBTYPES

TOTAL BUILDING SIZE

13000

STORIES

1

YEAR BUILT

1960

SPRINKLERS

-

PARKING SPACES

-

LAND DETAILS

CROSS STREETS

LAND ACRES

-

LAND SF

-

ZONING

-

APN/PARCEL ID

04-8-00060004

DONE

GET MORE INFO

Please correct the highlighted field(s).

Message sent.

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

THANK YOU

Your message has been successfully sent!

THANK YOU

Your message has been successfully sent!

Copyright © 1997-2025 CoStar Realty Information, Inc.

COMMERCIAL REAL ESTATE BY STATE

IndianaIowaKansasKentuckyLouisianaMaineMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontana

TOP COMMERCIAL REAL ESTATE MARKETS

COMMERCIAL REAL ESTATE BY STATE

IndianaIowaKansasKentuckyLouisianaMaineMarylandMassachusettsMichiganMinnesotaMississippiMissouriMontana

TOP COMMERCIAL REAL ESTATE MARKETS

GET MORE INFO

Please correct the highlighted field(s).

Message sent.

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

THANK YOU

Your message has been successfully sent!

9,380 SF | 1 Space

513 Stokes Dr

Please correct the highlighted field(s).

Message sent.

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

4 PHOTOS

Please correct the highlighted field(s).

Message sent.

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.