$5,240,000 USD

702-482-9675

4905 W Tropicana Ave

Las Vegas, NV 89103

Spring Valley

OVERVIEW

PREMIER GLOBAL TENANCY

As a leading retailer and one of the largest purchasers of prescription drugs in the world, Walgreens is consistently among the largest U.S. companies by revenue and ranks #26 on the 2025 Fortune 500 list. In September 2025, Walgreens was taken private by Sycamore Partners, a private equity firm specializing in consumer and retail-related investments. At time of acquisition (Q3 FY 2025), Walgreens reported TTM Revenue of $154.5 billion and TTM Adjusted EBITDA of $3.8 billion as of May 31, 2025. S&P and Moody’s withdrew all of their ratings on Walgreens Boots Alliance Inc. and Walgreen Co. following the completion of the company’s acquisition by Sycamore Partners. At time of withdraw, S&P’s long-term issuer credit rating was BB- and Moody’s corporate family rating was Ba3.

STRATEGIC LOCATION | PRIMARY RETAIL & COMMERCIAL CORRIDOR

The site is strategically located as an outparcel to the Trop Plaza shopping center, which is anchored by EoS Fitness and further occupied by Starbucks, Subway, Papa Johns Pizza, Denny’s, Wingstop, Sushi 21 and Parsely Modern Mediterranean, among others. The center is immediately adjacent to the 88-acre Charlie Frias Park, with other major tenants in the immediate vicinity including The Home Depot, Jack in the Box, Bank of America, Harbor Freight, Panda Express, Verizon and 7-Eleven, to name a few. Walgreens benefits from its location within southwest Las Vegas’ primary retail and commercial corridor, with a total of 17.9 MSF of retail, 6.9 MSF of office, 32 MSF of industrial and 33,497 multi-family units within a 3-mile radius of the site.

FOR SALE DETAILS

PRICE

$5,240,000 USD

PRICE/SF

$349 USD /SF

CAP RATE

7.5%

% LEASED

-

TENANCY

Single

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Drug Store

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1999

SPRINKLERS

-

PARKING SPACES

89

LAND DETAILS

LAND ACRES

1.65 AC

LAND SF

71,874 SF

ZONING

C2, County

APN/PARCEL ID

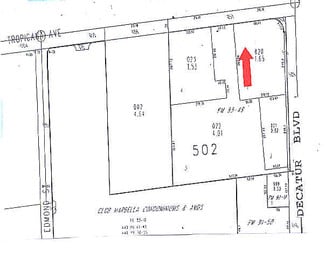

163-25-502-020

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

702-482-9675

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

702-482-9675

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.