$6,113,300 USD

651-492-2183

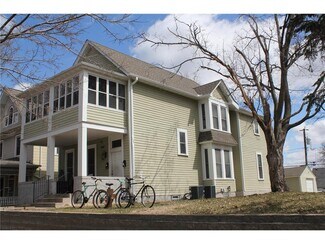

49 Manitoba Ave

Saint Paul, MN 55117

South of Maryland

HIGHLIGHTS

- Stabilized 17-property portfolio with 35 residential units in St. Paul.

- Predictable income tied to HUD AMI guidelines, insulated from market volatility.

- Opportunity for rent growth with transition from 50% to 60% AMI post-2028.

- Reduced property taxes under 4D Affordable classification and rent control exemption.

- Projected 2026 NOI of $188,452 with strong operating history and City-backed program continuity.

- Saint Paul HRA is considering carrying back a 2nd position low interest loan of $4,400,000 for this package.

OVERVIEW

This offering presents a rare opportunity to acquire a stabilized 17-property, 35-unit residential portfolio strategically located in St. Paul, Minnesota. The portfolio operates under the Neighborhood Stabilization Program (NSP), ensuring predictable income tied to HUD Area Median Income (AMI) guidelines rather than market volatility. Current rents are based on 50% AMI, with a clear path to incremental revenue growth through a proposed transition to 60% AMI at the program’s maturity in August 2028. Properties benefit from reduced property taxes under the 4D Affordable classification and exemption from St. Paul’s rent stabilization ordinance, creating a favorable regulatory environment.

The portfolio comprises primarily duplex homes with larger family-sized units, including multiple four- and five-bedroom residences, totaling approximately 36,960 rentable square feet. Parking amenities include garages and off-street spaces, enhancing tenant retention. Financial performance is supported by consistent rent collections, normalized operating expenses, and a projected 2026 NOI of $188,452. The offering contemplates a purchase price of approximately $6.1 million, with existing affordability mortgages structured in subordinate lien positions and expected to be forgiven upon NSP covenant satisfaction.

This investment combines stable cash flow, tax advantages, and long-term affordability commitments aligned with City support, making it an attractive acquisition for investors seeking predictable returns and community impact.

FOR SALE DETAILS

PRICE

$6,113,300 USD

PRICE/SF

$165 USD /SF

# OF UNITS

35

PRICE/UNIT

$174,666

CAP RATE

Request Cap Rate

% LEASED

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

17-Property Portfolio - St. Paul, MN

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Garden

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

2

YEAR BUILT

1900

PARKING SPACES

-

LAND DETAILS

LAND ACRES

0.11 AC

LAND SF

4,792 SF

ZONING

Residential

APN/PARCEL ID

30-29-22-32-0098

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

651-492-2183

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

651-492-2183

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.