$12,330,000 USD

424-407-1817

4801 West Fwy

Fort Worth, TX 76107

Western Hills/Ridglea

HIGHLIGHTS

- The PARC is a purpose-built flagship veterinary hospital with an award-winning design, renowned for its pet care, operating 24/7, 365 days a year.

- Compelling NNN lease with a corporate guarantee from Thrive Pet Healthcare, with six years remaining on their initial term, plus renewal options.

- Located in an affluent node west of Fort Worth, with an average household income soaring above the national average within a 2-mile radius.

- Positioned for unmatched visibility and accessibility, facing over 120,000 vehicles per day on Interstate 30, just 9 miles from Downtown Fort Worth.

- Below-market rent per square foot, relative to modern medical builds, with annual 2.75% increases, driving long-term value and steady return.

OVERVIEW

A landmark of modern veterinary medicine – a facility that has redefined the standard of veterinary care – is now on the market for sale. The PARC – Fort Worth’s Flagship 24/7 emergency veterinary clinic, located in the heart of Dallas-Fort Worth and listed exclusively by Daniel Solomon and Jackie Moeller of The Solomon Healthcare Advisory Team at Kidder Mathews.

The PARC isn’t just a veterinary hospital – it was envisioned, designed, and built to redefine what pet care can be. The PARC was created around the revolutionary idea of People first, Animals at the heart of it, Revolutionary Care throughout. The hospital is designed to strengthen the bond between pets and the people who love them through transparency, comfort, and trust, with an open, glass environment that keeps pet parents informed and reassured at every step. Care is tailored to each animal’s unique needs, supported by advanced technology, rapid diagnostics, and flexible options, such as outdoor exams for pets that feel safer outside. This people and pet-centered model is what makes the care truly revolutionary; a 24/7 commitment to helping pets and their families feel better, live better, and love longer.

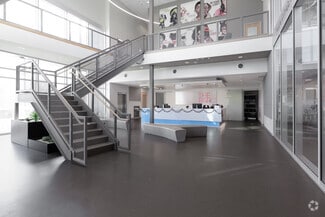

Positioned along one of Fort Worth’s busiest corridors with visibility to over 120,000 vehicles daily, The PARC represents a rare opportunity to acquire a premier veterinary campus in one of the nation’s fastest-growing metros. Constructed in 2018 at a cost of approximately $11 million, this 23,088-square-foot facility was purpose-built to deliver a revolutionary standard of care for pets and their owners. Its award-winning design features glass-walled treatment rooms, abundant natural light, and an open-concept layout that enhances transparency and client experience.

4801 West Freeway is fully leased to Thrive Pet Healthcare, a nationally recognized operator with approximately 400 locations and robust private equity backing from TSG Consumer Partners. The lease offers a corporate guarantee, NNN structure, and above-average annual rent escalations of 2.75%, creating a highly passive investment profile. With six years remaining on the initial term and three, five-year renewal options, investors benefit from long-term income stability and built-in growth.

Strategically located in west Fort Worth, the asset serves an affluent demographic with an average household income of $104,285 within a 2-mile radius. Its proximity to University Park Village and Chapel Hill Shopping Center ensures strong synergy with surrounding retail and lifestyle amenities. As veterinary construction costs soar, duplicating this facility today would require significantly higher capital, underscoring its intrinsic value relative to replacement cost.

This is a rare chance to secure a trophy healthcare asset in a market defined by population growth, corporate relocations, and resilient demand drivers.

FOR SALE DETAILS

PRICE

$12,330,000 USD

PRICE/SF

$534 USD /SF

CAP RATE

6%

% LEASED

-

TENANCY

Single

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

The PARC Veterinary Campus - 24/7 Emergency

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Veterinarian/Kennel

ADD'L SUBTYPES

Medical

TOTAL BUILDING SIZE

-

STORIES

2

YEAR BUILT

2018

SPRINKLERS

-

PARKING SPACES

54

LAND DETAILS

LAND ACRES

1.25 AC

LAND SF

54,450 SF

ZONING

-

APN/PARCEL ID

41044061

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

424-407-1817

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

424-407-1817

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.