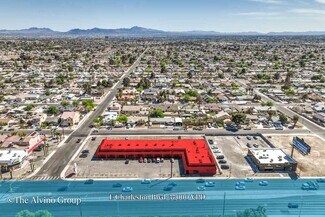

4777 E Charleston Blvd - Storefront FOR SALE

Las Vegas, NV 89104 |

4777 E Charleston Blvd

Las Vegas, NV 89104

FOR SALE DETAILS

PRICE

-

CAP RATE

-

% LEASED

-

TENANCY

-

BUILDING DETAILS

PROPERTY NAME

Plaza Mexico | Actual 6.90% Cap Rate

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Storefront

ADD'L SUBTYPES

Convenience Store, Fast Food, Supermarket

TOTAL BUILDING SIZE

17352

STORIES

1

YEAR BUILT

1986

SPRINKLERS

-

PARKING SPACES

80

LAND DETAILS

LAND ACRES

-

LAND SF

-

ZONING

-

APN/PARCEL ID

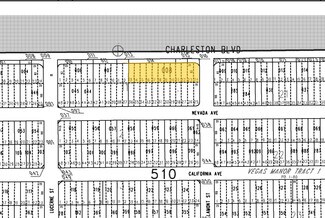

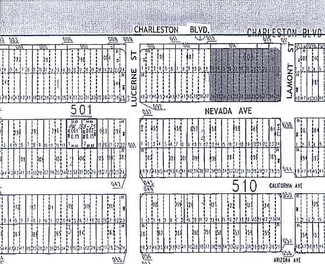

161-05-510-008