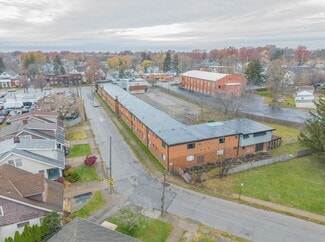

4755 Pearl Rd

Cleveland, OH 44109

Old Brooklyn

OVERVIEW

The Finley on Pearl represents a relatively low-risk redevelopment opportunity in a high-demand Cleveland neighborhood, supported by city initiatives that target infill and mixed-use investment in areas just outside growth corridors. The project benefits from city approvals for zoning and plans, along with a 15-year tax abatement, aligning with Cleveland’s broader goal to produce 23,000 new or substantially rehabilitated housing units through targeted incentives and streamlined approvals.

The property is currently vacant with a estimated redevelopment cost of $1,450,000, positioning the asset as a value-add play relative to prevailing multifamily pricing and cap rates in the metro. Based on the current underwriting, a stabilized Year 1 net operating income that supports a 10.1% capitalization rate implies a yield premium to both typical Cleveland value-add multifamily cap rates, which are quoted around the 6% - 7%, and broader metro averages reported near 9%.

An exceptional opportunity is available for a new investor to redevelop a market-rate multifamily property, offering returns that significantly exceed market performance by the conclusion of the first-year lease-up.

FOR SALE DETAILS

PRICE

$950,000 USD

PRICE/SF

$37 USD /SF

# OF ROOMS

42

PRICE/ROOM

$22,619 {currency}

CAP RATE

10.1%

STATUS

Converted

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

The Finley on Pearl

PROPERTY TYPE

Hospitality

TOTAL BUILDING SIZE

-

STORIES

2

ROOM ENTRANCE

Exterior

BUILDING CLASS

C

YEAR BUILT

1956

PARKING SPACES

40

LAND DETAILS

LAND ACRES

1.26 AC

LAND SF

54,886 SF

ZONING

C1, Cleveland

APN/PARCEL ID

011-12-009,011-12-010

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

216-403-9294

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

216-403-9294

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.