3050 Coon Rapids Blvd NW - Freestanding FOR SALE

Coon Rapids, MN 55433- Outer Coon Rapids/Fridley/Blaine |

$2,600,000 USD

612-444-3333

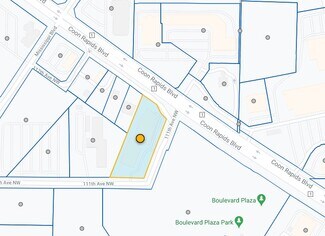

3050 Coon Rapids Blvd NW

Coon Rapids, MN 55433

Outer Coon Rapids/Fridley/Blaine

HIGHLIGHTS

OVERVIEW

Currently, the building is leased at below-market rental rates, leaving significant room for future income upside as leases turn over or are renegotiated. The tenant base is composed of a solid mix of occupants from various industries, providing diversification and reducing the risk associated with vacancy or market shifts. In addition to its favorable zoning and tenant structure, the property has recently undergone major renovations totaling approximately $750,000. These capital improvements were completed by the current ownership and address many of the typical deferred maintenance items, positioning the building for reduced operational costs in the near

term and increased attractiveness to new tenants. Overall, this asset combines strong fundamentals with meaningful upside potential, making it an ideal candidate for investors seeking both stability and growth in a well-located commercial property

FOR SALE DETAILS

PRICE

$2,600,000 USD

PRICE/SF

$83 USD /SF

CAP RATE

8.12%

% LEASED

-

TENANCY

Multiple

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Freestanding

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1978

SPRINKLERS

-

PARKING SPACES

92

LAND DETAILS

LAND ACRES

1.8 AC

LAND SF

78,408 SF

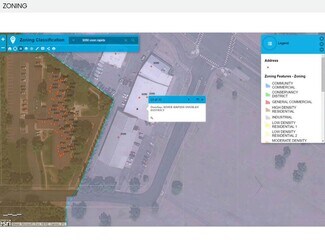

ZONING

Hwy Commercial

APN/PARCEL ID

16-31-24-32-0007

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

612-444-3333

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

612-444-3333

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.