301 W 3rd St - Manufacturing FOR SALE

Sterling, IL 61081 |

310-261-8428

301 W 3rd St

Sterling, IL 61081

OVERVIEW

Seller is motivated

DWG Capital Group, as the exclusive advisor, is pleased to present an exceptional opportunity to acquire The Sterling Landmark—a premier industrial value-add asset located at 301 W 3rd St, Sterling, IL. This expansive property combines strong income-generating potential with substantial upside, situated in a region with robust industrial fundamentals. 301 W 3rd St, Sterling, IL presents a very attractive investment opportunity and ideal for immediate repositioning and profit, please get us your highest and best.

Investment Highlights

Offering Price: $11,975,000 ($24.59/SF)—positioned 67% below recent area comparable sales. (GET US YOUR HIGHEST AND BEST)

Projected Stabilized Net Operating Income (NOI): $1,830,000

Cap Rate (NNN Basis): 7.75%-8%

Adjusted Bank Value (NNN Analysis): $23,612,903, highlighting significant value creation potential.

Strategic Location: Pro-business area with access to major MSAs including Chicago, Quad Cities, Rockford, Milwaukee, and Kansas City.

Property Overview

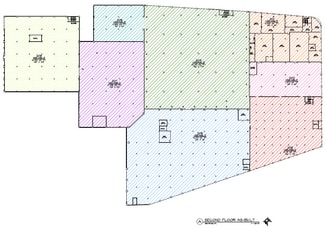

Building Size: ±486,952 SF on ±7.16 acres

Versatile Use Potential: Ideal for manufacturing, warehousing, distribution, and other high-value industrial applications.

Infrastructure: 18 external dock doors, 3 drive-ins, with extensive power and sprinkler systems for high-capacity operations.

Capital Improvements: Over $3.1M in recent upgrades, including a new 20-year warranty roof.

Pro Forma Analysis

With a projected stabilized NOI of $1,830,000 at a 7.75% cap rate, the asset's adjusted bank valuation is estimated at $23,612,903, providing a compelling value-add proposition. Potential pro forma exit values range between $20M–$23M, equating to approximately $41 to $47 per square foot (PSF). This pricing offers substantial upside and attractive IRR potential for investors.

This is a rare opportunity to acquire a sizable, strategically located industrial asset with VERY favorable acquisition pricing, significant value-add potential, and robust pro forma returns.

We welcome the opportunity to discuss this exclusive offering and explore how it aligns with your investment strategy.

Warm Regards,

Judd Dunning License #01520854

Principal | Broker

DWG Capital Group (formerly Newmark WLA)

310.261.8428 | jdunning@dwg-re.com

FOR SALE DETAILS

BUILDING DETAILS

PROPERTY NAME

486Ksf Illinois Industrial Massive Value Add!

PROPERTY TYPE

Industrial

PROPERTY SUBTYPE

Manufacturing

TOTAL BUILDING SIZE

-

STORIES

3

YEAR BUILT

1970

UTILITIES

Lighting, Gas - Natural, Water - City, Sewer - City, Heating - Gas

CLEAR CEILING HT

15 Ft

DOCKS

18

DRIVE INS

3

PARKING SPACES

60

LAND DETAILS

LAND ACRES

6

LAND SF

261,360

ZONING

M-1

APN/PARCEL ID

1121386023,1121386029

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

310-261-8428

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

310-261-8428

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.