29673 Rock Creek Dr - Residential Income FOR SALE

Three Rivers, CA 93271 |

$3,150,000 USD

559-705-1000

29673 Rock Creek Dr

Three Rivers, CA 93271

HIGHLIGHTS

- Investment Opportunity: Operational Business & Rental Income

- Turn Key Purchase + Business + Bonus Land in Three Rivers, CA

- Upside Potential: 8.82% Cap Rate & $450K in Rents

- ±7,800 SF of Air BnB Properties on 10.86 Acres w/ Great Potential

- Established Airbnb Listings with Consistently High Guest Ratings

- Perfect Opportunity For a Family Run Business

OVERVIEW

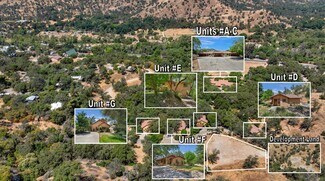

Operational business & rental income opportunity: offering (7) residential units totaling ±7,800 SF currently utilized as Air BnB properties in Three Rivers, CA. Property consists of (1) triplex (#A–C) and (4) separately metered units with covered parking, all situated on ±10.86 acres. The triplex includes Unit A, ±1,200 SF with 2 bedrooms and 2 bathrooms; Unit B, ±1,250 SF with 2 bedrooms and 2 bathrooms; and Unit C, ±1,200 SF, also configured as 2 bedrooms and 2 bathrooms. Unit D, located up the road, is ±900 SF and features 1 bedroom, 1 office, and 1.5 bathrooms. Unit E is ±1,000 SF and offers 1 bedroom, 1 basement room, and 2 bathrooms. Further up the road, Unit F is ±1,250 SF and includes 2 bedrooms and 2 bathrooms. Lastly, Unit G is ±1,000 SF with 1 bedroom, 1 loft room, and 2 bathrooms. The units are spacious, there is on-site parking and exterior lighting throughout the property. Low cost County sewer/water services in place. The property is within a few miles from restaurants, shops, & just 4 miles from the entrance to Sequoia Park.

Value-Add Investment Opportunity: This asset presents a rare opportunity to acquire a stabilized short-term rental property in the high-demand market of Three Rivers, CA, with clear upside potential. The current operation includes 7 Airbnb units 5 of which are restricted to single-bedroom occupancy and marketed exclusively to couples but can accommodate up to 4 to 6 people if needed. However, the property contains a total of 10 bedrooms, offering immediate value-add upside through reconfiguration and utilization of all available sleeping areas. The value-add strategy consists of increasing nightly rates over time, driven by the property's highly desirable location, proximity to Sequoia National Park, and the all-inclusive, turnkey rental experience. Actual rents generate $394,750.20 in gross annual income with limited operational optimization. A strategic adjustment to fully utilize existing bedrooms and increase average nightly rates by $50–$100 positions the property to achieve a realistic stabilized gross income of approximately $450,000 annually. This unique offering features easy-to-rent, small-format units within an under-supplied market and strong traveler demand. Once stabilized, the investment is projected to yield an 8.82% cap rate, making it a highly attractive option for investors seeking cash-flowing hospitality assets with operational upside.

FOR SALE DETAILS

PRICE

$3,150,000 USD

PRICE/SF

$404 USD /SF

CAP RATE

8.82%

% LEASED

-

TENANCY

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

(7) Fully-Operational Airbnb Units in Scenic

PROPERTY TYPE

Specialty

PROPERTY SUBTYPE

Residential Income

ADD'L SUBTYPES

Hotel

TOTAL BUILDING SIZE

-

STORIES

1

BUILDING CLASS

-

YEAR BUILT

2005

SPRINKLERS

-

PARKING SPACES

-

LAND DETAILS

LAND ACRES

10.86 AC

LAND SF

473,062 SF

ZONING

R-3

APN/PARCEL ID

067-190-028-000

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

559-705-1000

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

559-705-1000

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.