$1,850,000 USD

310-729-1559

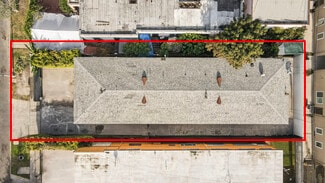

2804 S Norton Ave

Los Angeles, CA 90018

West Adams

HIGHLIGHTS

- Ideal unit mix, consisting of (2) 2 Bed/1 Bath, (1) 3 Bed/1 Bath, (1) 3 Bed/2 Bath, and (1) 3 Bed/2.5 Bath Units

- Four of the five units are currently occupied by HACLA tenants, providing stable, government-backed rental income

- Conveniently located in West Adams, the property is surrounded by restaurants, shopping centers, and major metropolitan hubs

OVERVIEW

2804 Norton Ave is a rare, high-yield 5-unit apartment located in a prime pocket of West Adams, offering strong in-place cash flow supported by highly desirable unit

layouts. The property benefits from special financing available at 80% LTV with 30-year interest-only terms, creating an attractive leverage opportunity for investors. The asset delivers a 7.06% going-in cap rate and a 7.33% cash-on-cash return while trading at under $400 per square foot, a compelling basis for the submarket. Four of the five units are large, townhome-style residences, a layout that is extremely desirable to tenants and consistently drives strong rents with lower turnover. The property’s total average monthly rent exceeds $3,000 per unit, highlighting the durability of the in-place income. Additionally, four of the five units are leased under HACLA, providing government guaranteed rents and long-term income stability. This is a turn-key opportunity to acquire stable cash flow, favorable long-term debt, and well-positioned multifamily housing in one of Los Angeles’ most active neighborhoods.

FOR SALE DETAILS

PRICE

$1,850,000 USD

PRICE/SF

$448 USD /SF

# OF UNITS

5

PRICE/UNIT

$370,000

CAP RATE

7.06%

% LEASED

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

2

YEAR BUILT

1964

PARKING SPACES

-

LAND DETAILS

LAND ACRES

0.12 AC

LAND SF

5,301 SF

ZONING

LARD1.5

APN/PARCEL ID

5051-010-002

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

310-729-1559

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

310-729-1559

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.