OVERVIEW

Vacant Value Add Building Owner willing to Sale or Lease (Lease for $6000.00 per month 8 dollars a Square Foot)

Dollar General operates more than 19,000 stores across the United States and continues to expand with additional ground-up developments. The company’s ongoing investments in new Distribution Centers and its growing “DG Market” format reflect a strategic push toward greater operational efficiency and broader product offerings.

Corporate Strength & Stability

As a publicly traded Fortune 500 company, Dollar General has a long-standing track record of strong financial performance. The brand is considered highly resilient—even in economic downturns—due to its value-oriented model, often described as the small-town equivalent of a Walmart.

Demonstrated Sales Growth

The company continues to show healthy retail performance, reporting same-store sales increases of over 4% year-over-year along with a more than 10% rise in net sales. These metrics underscore Dollar General’s ongoing commitment to opening and operating successful locations.

Long-Term Profitability Outlook

With its expanding distribution network, reduced logistics costs, and increased average basket size per customer, Dollar General is well-positioned for sustained profitability and operational efficiency throughout its national footprint.

Investing in Dollar General real estate offers dependable returns with room for growth. Roughly 70% of their stores operate successfully in smaller communities with fewer than 20,000 residents, where competition from big-box retailers is minimal.

Most Dollar General leases are structured as absolute triple-net (NNN) agreements spanning 15 years, providing investors with predictable, low-maintenance income. In comparison, Dollar Tree and Family Dollar locations typically feature double-net (NN) leases with 10-year terms.

This property represents a value-add retail investment with

strong upside potential due to its location,

traffic exposure, and discounted acquisition cost.

The key to unlocking value will be securing a tenant or

repositioning the property for alternative use.

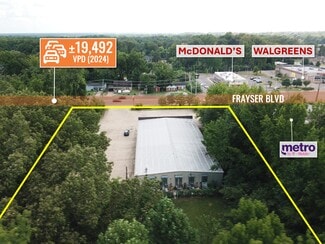

Prime location with strong traffic and retail synergy

Large lot size with flexible redevelopment options

Heavy traffic flow supports retail viability.

Surrounded by national chains, indicating strong consumer

demand.

Industrial adjacency (Nike & Amazon hub) adds work force-driven retail demand.

Surrounding Retail: Kroger, Walgreens, McDonald’s, Family Dollar,

Subway, Cricket, Advance Auto Parts

Proximity: 1 mile from Amazon & Nike’s 2.8M sq. ft. distribution

hubs

Value-Add Potential:

Re-tenanting opportunity with national or local retailers

Potential conversion to alternative uses (community center, medical

office, storage, etc.)

Also available for lease at $6k monthly

FOR SALE DETAILS

PRICE

$750,000 USD

PRICE/SF

$81 USD /SF

CAP RATE

Request Cap Rate

% LEASED

-

TENANCY

Single

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Dollar General

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Freestanding

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

2009

SPRINKLERS

-

PARKING SPACES

30

LAND DETAILS

LAND ACRES

1.9 AC

LAND SF

82,764 SF

ZONING

CMU-1

APN/PARCEL ID

07-2104-0-0038

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

901-881-2070

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

901-881-2070

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.