2606 NE Bob Bullock Loop - Storefront FOR SALE

Laredo, TX 78045 |

$3,579,000 USD

480-718-5555

2606 NE Bob Bullock Loop

Laredo, TX 78045

HIGHLIGHTS

- Triple Net (NNN) Lease Structure: Minimal landlord responsibilities, providing reliable, hands-off income with strong tenant covenant.

- Rare Two (2) Drive-Thru Configuration: Highly desirable post-pandemic asset feature that supports tenant retention

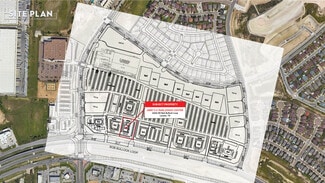

- Prime ±1.366-Acre Pad Site: Positioned at the forefront of a planned Lowe’s-anchored shopping center, enhancing long-term value and visibility

- Outstanding Access & Exposure: Frontage on NE Bob Bullock Loop, one of Laredo’s highest-trafficked corridors (16,277 CPD)

- Retail Critical Mass: Located within Laredo’s dominant retail node — surrounded by over 40 national big-box retailers

- nstitutional Demand Drivers: Near major education and medical institutions including Texas A&M International University (8,536 students)

OVERVIEW

Presenting a rare chance to acquire a fully stabilized, 100% occupied retail center anchored by three nationally recognized QSR tenants: Arby’s, Papa John’s, and McAlister’s Deli — each under long-term, 10-year NNN leases with built-in rental escalations, providing passive income and strong hedge against inflation. This asset represents a high-quality, low-management investment opportunity in a supply-constrained submarket experiencing robust retail demand and population growth.

Market Snapshot – Laredo, TX: Laredo is a fast-growing border city with a population exceeding 250,000 and a robust industrial and logistics economy due to its proximity to Mexico and strategic location along major trade corridors. Its retail sector benefits from strong cross-border consumer spending, minimal retail vacancy rates, and a business-friendly environment that supports sustained commercial growth.

Summary: This retail asset combines the security of long-term national tenants, desirable NNN lease structure, strategic location within a high-traffic trade area, and rare physical features (dual drive-thrus) that significantly enhance tenant desirability and investor appeal. Ideal for private investors, REITs, or 1031 exchange buyers seeking predictable income, capital preservation, and future appreciation in a thriving Sun Belt market.

FOR SALE DETAILS

PRICE

$3,579,000 USD

PRICE/SF

$550 USD /SF

CAP RATE

6.5%

% LEASED

-

TENANCY

Multiple

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Arby's & Papa John's Center - LAREDO, TX

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Storefront

ADD'L SUBTYPES

Fast Food, Freestanding, Restaurant

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

2022

SPRINKLERS

-

PARKING SPACES

-

LAND DETAILS

LAND ACRES

1.36 AC

LAND SF

59,242 SF

ZONING

Commercial

APN/PARCEL ID

206066

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

480-718-5555

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

480-718-5555

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.