$2,350,000 USD

916-996-4421

2375 W 12th St

Los Angeles, CA 90006

Harvard Heights

OVERVIEW

This value-add opportunity consists of 11 multifamily units, providing investors with stable in-place income and meaningful upside through rent growth, interior renovations, and operational improvements. The property offers a balanced mix of (4) two-bedrooms, (6) one-bedrooms, and (1) studio, appealing to a wide tenant base and helping mitigate vacancy risk.

With LAR4 zoning on a 13,999 SF lot, the property holds long-term potential for redevelopment or expansion strategies, while immediate upside exists through RUBS implementation, laundry income, and parking monetization. Currently generating $157,584 annually versus market rent potential of $275,490, investors can unlock more than $117K in additional income by repositioning units to market levels.

SELLER CARRY AVAILABLE

Located at the Koreatown–Westlake border, the property benefits from strong renter demand driven by proximity to Downtown Los Angeles, Wilshire Boulevard, and two Metro Red & Purple Line stations. The neighborhood’s cultural vibrancy, 24-hour dining, and walkability ensure consistent tenant interest and long-term occupancy stability.

For investors, 2375 W 12th St represents an immediate opportunity to capture value by bridging the gap between current and market rents. At an asking price of $2,350,000 (~$214K per unit / $191 per SF), the asset delivers a 3.44% in-place cap rate and a pro forma cap rate of 8.01%, making it a compelling option for those seeking both day-one income and long-term appreciation in one of Los Angeles’s most dynamic rental markets.

FOR SALE DETAILS

PRICE

$2,350,000 USD

PRICE/SF

$183 USD /SF

# OF UNITS

11

PRICE/UNIT

$213,636

CAP RATE

3.44%

% LEASED

100%

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

2

YEAR BUILT

1923

PARKING SPACES

6

LAND DETAILS

LAND ACRES

0.33 AC

LAND SF

14,235 SF

ZONING

R4-2, Los Angeles

APN/PARCEL ID

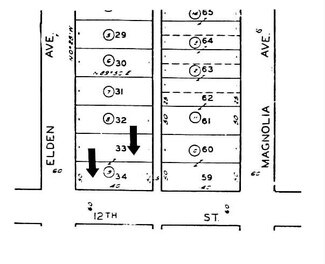

5076-012-009

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

916-996-4421

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

916-996-4421

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.