226 New Brunswick Ave - Apartments FOR SALE

Perth Amboy, NJ 08861 |

$5,900,000 USD

772-985-2577

226 New Brunswick Ave

Perth Amboy, NJ 08861

HIGHLIGHTS

- Fully Renovated Mixed-Use Asset with Stabilized Cash Flow & Upside

- Stabilized 18-unit multifamily plus 100% occupied 3-unit commercial

- Gut-Renovation completed in 2024: All new systems: plumbing, electrical, mechanical.

- Tenant's are directly metered for water, electric and heat and hot water. The owner is responsible for only common area electric.

- Solid Commercial Tenancy: Harborx Pharmacy, Amarilis Furniture and Charming Lady, LLC with multi-year leases and built-in escalations

- Turnkey Asset: Delivered in excellent condition and with stabilized occupancy

OVERVIEW

Aria Apartments is a fully gut renovated mixed use asset located in the heart of Perth Amboy. It provides a rare combination of modern construction quality, diversified income, long term regulatory protection, and a stable yield profile that aligns directly with institutional investment criteria. The property was originally industrial and was transformed into a modern residential mixed use building, qualifying it for New Jersey’s Newly Constructed Multiple Dwelling Exemption. This exemption provides up to 30 years of relief from local rent control and rent leveling ordinances, allowing ownership to maintain market driven rent growth, reduce long term regulatory exposure, and preserve exit value.

The building has undergone a complete renovation with new mechanical systems, upgraded electrical and plumbing, life safety improvements, and updated residential and commercial interiors. These improvements materially lower capital expenditure requirements and support consistent long-term operations. The electrical capacity was recently upgraded with a new 1,200-amp system. All utilities (electrical, heat, and water) are directly metered and the tenant is responsible for each, thereby eliminating any risks associated with future increases. The roof was newly installed mid 2017 with a complete 15-year warranty that has 7 remaining years.

The property was intentionally leased at slightly below-market rent levels following the renovations in order to achieve rapid stabilization and full occupancy. The pro forma reflects the property’s true market potential, with average rents approximately $100 per unit higher than current in-place levels. From a financial standpoint, the Offering Memorandum reflects a purchase price of $5,900,000, an actual cap rate of 6.27%, and a pro forma cap rate of 6.59%. These metrics underscore the property’s enhanced marketability, upside potential through rent growth, and strong operating efficiency.

FOR SALE DETAILS

PRICE

$5,900,000 USD

PRICE/SF

$233 USD /SF

# OF UNITS

18

PRICE/UNIT

$327,778

CAP RATE

6.59%

% LEASED

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

3

YEAR BUILT

2019

PARKING SPACES

-

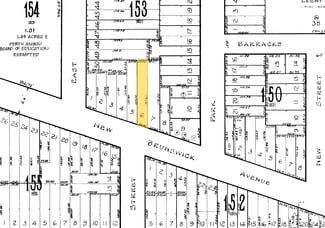

LAND DETAILS

LAND ACRES

0.21 AC

LAND SF

9,148 SF

ZONING

C-1

APN/PARCEL ID

16-00153-0000-00006

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

772-985-2577

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

772-985-2577

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.