$2,862,650 USD

602-538-7155

2230 E Bell Rd

Phoenix, AZ 85022

Paradise Valley North

HIGHLIGHTS

- 10 year primary lease term

- Strong corporate guaranty

- Densely populated trade area

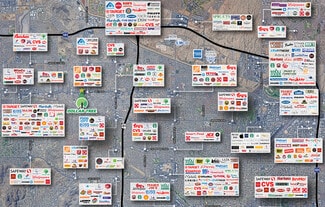

- Surrounded by national tenants including The Home Depot, AutoZone, McDonald's, Discount Tire and more

- Dollar Tree (NASDAQ: DLTR) has a market cap of $19.39 billion

- Positioned at a signalized intersection with combined traffic counts of approximately 92,663 vehicles per day

OVERVIEW

Cushman & Wakefield is pleased to present the opportunity to acquire a net leased investment tenanted by Dollar Tree, one of the most recognizable and established discount retailers in the United States. The property is secured by a corporate-signed lease, providing investors with a stable and predictable income stream backed by a national credit tenant with a long operating history and a proven, necessity-based business model.

Founded in 1986 and headquartered in Chesapeake, Virginia, Dollar Tree has grown into one of the largest value-oriented retail platforms in North America. As of 2025, the company operates over 16,500 locations across 48 states and Canada. Dollar Tree is publicly traded on the NASDAQ (DLTR) and reported trailing twelve-month revenues of approximately $30.6 billion, reflecting the brand’s scale, operational consistency, and resilience across economic cycles. The company’s focus on everyday essentials at accessible price points positions it as a recession-resistant tenant with strong consumer demand.

The subject property is located at 2230 E Bell Road in Phoenix, Arizona, a densely populated infill trade area with strong traffic fundamentals. The site benefits from proximity to U.S. Route 51, exposure to high daily vehicle counts, and surrounding national retailers including The Home Depot, AutoZone, McDonald’s, and Discount Tire. Strong residential density and household incomes further support sustained store performance.

This offering represents an opportunity to acquire a well-located Dollar Tree investment with durable cash flow, minimal landlord responsibilities, and long-term value supported by a nationally dominant discount retailer.

FOR SALE DETAILS

PRICE

$2,862,650 USD

PRICE/SF

$317 USD /SF

CAP RATE

6%

% LEASED

-

TENANCY

Single

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Dollar Tree

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Storefront

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1998

SPRINKLERS

-

PARKING SPACES

40

LAND DETAILS

LAND ACRES

0.99 AC

LAND SF

43,124 SF

ZONING

C-C

APN/PARCEL ID

214-08-026A

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

602-538-7155

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

602-538-7155

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.