$3,999,000 USD

901-277-3093

211-230 S Riverside Ave

Rialto, CA 92376

Downtown Rialto

HIGHLIGHTS

- High-Yield 7.86% Cap Rate in In-Place Income

- Highly Diversified Rent Roll – 30+ tenants with no single tenant exceeding 8% of total income, minimizing concentration risk.

- Fully NNN-Leased Asset – Tenants proportionately reimburse all operating expenses, including property taxes, insurance, and CAM.

- Dedicated On-Site Parking – The property features ±51 dedicated on-site parking stalls supplemented by street-front parking

- Recent Capital Improvements – Upgrades include new roofs, parking lot slurry seal and striping, new HVAC units, interior paint, new flooring

- Flexible Zoning Allowing Specialized Uses – The property’s Downtown Mixed-Use (DMUZ) zoning permits a wide variety of uses

OVERVIEW

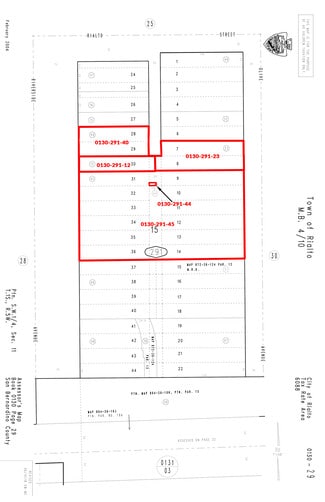

Progressive Real Estate Partners is proud to present the opportunity to acquire a Downtown Rialto Multi-Tenant Commercial Center located along Riverside Avenue, Rialto’s primary north-south corridor between the 210 and 10 Freeways. The property consists of ±20,122 SF situated on ±1.35 acres across five separate parcels. Improvements include 8 street-front retail units, 27 incubator-style office suites, 1 flex warehouse unit with a loading dock, and a separately parceled single-family residence – totaling 37 units occupied by 30+ tenants. The asset is 95% leased and offers a 7.86% cap rate on in-place income at $199/SF, well below replacement cost. No tenant represents more than 8% of total income, providing strong diversification and insulation from vacancy risk. The incubator office suites, averaging under 250 SF, maintain consistent occupancy due to affordability, limited competing product, and flexible zoning that supports a broad range of uses. The property includes ±51 dedicated on-site parking supplemented by street-front parking, broadening the appeal to potential tenants and enhancing the value of the asset.

FOR SALE DETAILS

PRICE

$3,999,000 USD

PRICE/SF

$199 USD /SF

CAP RATE

7.86%

% LEASED

-

TENANCY

Multiple

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

100% Leased Multi-Tenant Commercial Property

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Storefront Retail/Office

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1930

SPRINKLERS

-

PARKING SPACES

43

LAND DETAILS

LAND ACRES

1.35 AC

LAND SF

58,806 SF

ZONING

Downtown Mixed-Use (DMUZ)

APN/PARCEL ID

0130-291-12,0130-291-23,0130-291-40,0130-291-44,0130-291-45

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

901-277-3093

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

901-277-3093

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.