$4,225,000 USD

909-230-4500

211-230 S Riverside Ave

Rialto, CA 92376

Downtown Rialto

HIGHLIGHTS

- 7.80% Cap Rate on Actual Income and 9.51% by 2030

- 100% Leased (8 Retail Units | 27 Office Units | 1 Flex Units | 1 Residential Unit)

- Dense Trade Area (±160,000 in a 3-Mile Radius)

- $90,387 Average Household Income (1-Mile Radius)

- Positioned on Riverside Avenue – The Main Retail Corridor Between the I-10 and 210 Freeways

- Seller Has a Waiting List of Potential Tenants

OVERVIEW

STRONG INVESTMENT FUNDAMENTALS

7.82% Cap Rate on Actual Income and 9.50% by 2030

Diverse Income Stream – Income is spread across 33 tenants, with no individual tenant accounting for more than 8% of total revenue.

Fully NNN-Leased Asset – Tenants proportionately reimburse all operating expenses, including all property taxes, insurance, and CAM, minimizing landlord exposure.

Smaller, Easier-to-Lease Suites – Majority of units range from 125 SF to 950 SF, appealing to small businesses and limiting exposure to high vacancy risk.

Dense, Affluent Trade Area — ±160,000 residents within a 3-mile radius and an average household income of ±$90,400 within 1 mile radius.

Service-Oriented Office Users—Not traditional office space – Small, private suites cater to service-based professionals seeking affordable workspace.

Recent Capital Improvements – Significant upgrades include new roofs, parking lot slurry seal/stripe, new HVAC, interior paint, new flooring, and full renovation of unit 225-10 (±3,500 SF).

Built-In Rent Growth – Leases include embedded CPI or 3% annual increases, offering a hedge against inflation.

Attractive Basis vs. Replacement Cost – Offered at $210/SF, significantly below new construction costs estimated at $300–$400/SF in Southern California.

___________________________________________________________________________________________________________

RESIDENTIAL MIXED-USE DEVELOPMENT OPPORTUNITY

Residential Mixed-Use Development Opportunity – Zoned Downtown Mixed-Use (DMUZ) within the Foothill Central Specific Plan, offering future residential mixed-use development upside.

Fully Leased at Below Replacement Cost, Ideal for Covered Land Play – 100% occupancy with short-term leases generates steady cash flow, creating a low-risk hold while securing permits and approvals for future redevelopment.

FOR SALE DETAILS

PRICE

$4,225,000 USD

PRICE/SF

$210 USD /SF

CAP RATE

7.82%

% LEASED

-

TENANCY

Multiple

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

100% Leased Multi-Tenant Commercial Property

PROPERTY TYPE

Retail

PROPERTY SUBTYPE

Storefront Retail/Office

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

1930

SPRINKLERS

-

PARKING SPACES

43

LAND DETAILS

LAND ACRES

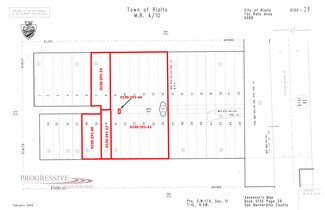

1.35 AC

LAND SF

58,806 SF

ZONING

Downtown Mixed-Use (DMUZ)

APN/PARCEL ID

0130-291-12,0130-291-23,0130-291-40,0130-291-44,0130-291-45

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

909-230-4500

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

909-230-4500

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.