$2,699,999 USD

818-388-4305

176-178 S Alvarado St

Los Angeles, CA 90057

Westlake North

OVERVIEW

13,000 SF two-story commercial building with a 3,000 SF first floor, 10,000 SF of total floor space, seven bathrooms, 15–17 gated parking spaces, a 123 ft × 62 ft building footprint, full two-story access, and existing medical-certified use. Elevator access, seven restrooms, and a versatile two-story layout support seamless occupancy for medical groups, behavioral health providers, outpatient clinics, physicians’ offices, law practices, creative studios, nonprofits, educational programs, and a wide range of professional service users.

The building is fully vacant, delivering 100% owner-user occupancy on Day 1. Historically, the asset supported strong rental income: the prior ground-floor tenant (Professional Lawyers Group) leased the entire ±3,000 SF level plus half the parking for $10,000/month, and the former upstairs tenant (La Day & Guerra General Partnership) leased the full ±6,000 SF second floor for $15,000/month under standard commercial lease terms. Historical lease documents are available for buyer review upon request.

With C2-1 zoning and its position within a transit-rich corridor, the property also presents meaningful long-term upside for mixed-use or multifamily redevelopment, including potential TOC density bonuses. The efficient ±125’ × 52’ footprint, gated parking, dual entries, and elevator-served interior make this building uniquely adaptable for healthcare, medical, wellness, and behavioral health operations—including outpatient care, intensive outpatient (IOP), partial hospitalization (PHP), administrative offices, or supportive-service programmatic uses (buyer to verify all licensing requirements).

?

Financial Overview — Pro Forma Only (Building Delivered Vacant)

The property will be delivered 100% vacant at close of escrow, allowing an owner-user or investor to occupy or reposition the building immediately. All financial figures referenced are pro forma estimates only, based on market rents for comparable medical, office, legal, and behavioral health facilities in the Westlake–Koreatown–DTLA corridor.

Under a stabilized lease-up scenario, the building may generate an estimated NOI of approximately $232,050, which reflects an estimated pro forma cap rate of ±8.6% at the $2,699,999 asking price. Historical leases indicate that previous tenants generated an estimated NOI of approximately $213,750, equating to an estimated historical cap rate of ±7.9% based on actual rents paid.

This information is provided solely for illustrative and informational purposes to demonstrate potential performance under market-supported assumptions. No income is currently being generated, and no representations or guarantees are made regarding future rents, tenant demand, operating expenses, redevelopment feasibility, or achievable cap rates. Buyer is solely responsible for verifying all income, expenses, market rents, zoning allowances, entitlement pathways, TOC eligibility, and overall financial feasibility.

FOR SALE DETAILS

PRICE

$2,699,999 USD

PRICE/SF

$291 USD /SF

CAP RATE

Request Cap Rate

% LEASED

-

TENANCY

Multiple

SALE TYPE

Investment Or Owner User

BUILDING DETAILS

PROPERTY TYPE

Office

PROPERTY SUBTYPE

Medical

TOTAL BUILDING SIZE

-

STORIES

2

BUILDING CLASS

C

YEAR BUILT

1951

SPRINKLERS

-

PARKING SPACES

15

LAND DETAILS

LAND ACRES

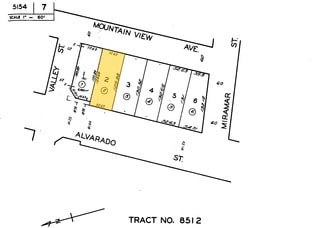

0.16 AC

LAND SF

6,835 SF

ZONING

C2-2

APN/PARCEL ID

5154-007-002

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

818-388-4305

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

818-388-4305

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.