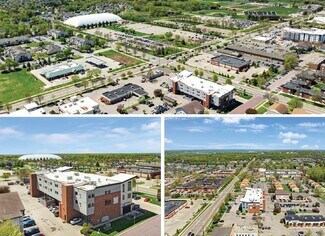

1633 Monks Ave

Mankato, MN 56001

University

HIGHLIGHTS

- STRATEGIC LOCATION - Located one block from Minnesota State University, Mankato which has enrollment of over 14,000 Students.

- SIGNIFICANT STUDENT HOUSING RENT GROWTH - Lofts@1633 has averaged 9% annual compounding rent growth for the last 5 rental seasons.

- HISTORY OF 100% OCCUPANCY - 69 student housing beds have been fully occupied for the previous 5 rental seasons.

- SERVICE-BASED RETAIL TENANCY - All retailers consist of service-based tenants that are resistant to e-commerce competition and market disruptions.

- RETAIL UPSIDE POTENTIAL - A new owner has the opportunity to create significant value by filling the existing retail vacancy.

- MINNESOTA’S SECOND LARGEST UNIVERSITY - Mankato is home to Minnesota State University which has enrollment of over 14,000 Students.

OVERVIEW

The offering consists of a three-story mixed-use property with 12,327 square feet of main floor retail and 69 beds of student housing. The asset is strategically located one block from Minnesota State University Mankato. MSU is Minnesota’s second largest university with enrollment exceeding 14,000 students located on a 300+ acre campus. The city of Mankato is 80 miles south of Minneapolis and has a population of 45,000 residents.

Lofts@1633 has had a consistent track record of 100% occupancy throughout its 69 student housing beds. Student rents at Lofts@1633 have averaged 9% annual compounding growth for the last 5 rental seasons. The retail rent roll consists of a diverse mix of national, regional, and local service-based retailers. The majority of retail rents are significantly below new construction competition resulting in high tenant demand and strong occupancy fundamentals for a new owner.

This offering delivers stable in-place cash flow while also providing the opportunity for significant upside potential. An investor can realize this upside by filling the existing retail vacancy and capitalizing on the student housing rent growth that has been demonstrated with this asset. Value creation will be driven largely by the opportunity to increase cashflows and through the irreplaceable infill location less than one block from the MSU Campus.

To view the OM, please sign the Confidentiality Agreement here:

https://www.cbredealflow.com/buyer/agreement?pv=kT0O5J9L2IE4Bg4PNiwcGEYgza-ehf5AVZ3N8t9OkKpoJY8Qrk0LWFqa1KqNbnhR

FOR SALE DETAILS

PRICE

$7,700,000 USD

PRICE/SF

$188 USD /SF

# OF UNITS

66

PRICE/UNIT

$116,667

CAP RATE

6.59%

% LEASED

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Lofts@1633

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

3

YEAR BUILT

1990

PARKING SPACES

71

LAND DETAILS

LAND ACRES

0.55 AC

LAND SF

23,958 SF

ZONING

Commercial

APN/PARCEL ID

R01-09-20-153-002,R01-09-20-153-016

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

952-210-0484

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

952-210-0484

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.