1619 San Juan Rd - Commercial LAND FOR SALE

Hollister, CA 95023 |

1619 San Juan Rd

Hollister, CA 95023

OVERVIEW

OPPORTUNITY ZONE PROPERTY!!!! THIS IS ONE OF THE ONLY 2 OPPORTUNITY ZONE PROPERTIES IN THE CITY OF HOLLISTER!

THIS IS NOT LEGAL NOR TAX ADVISE. PLEASE CONTACT YOUR ATTORNEY OR FINANCIAL ADVISOR FOR DETAILS.

Qualified Opportunity Zone Fund Investor

Eligible Capital Gains for investment into the Opportunity Zone Fund include gains recognizable from taxable exchanges such as: the sale of stocks or bonds, the sale of a property, or the sale of an interest in a partnership.

Both long term and short term Capital Gains can be invested into an Opportunity Zone Fund.

Gains taxed as ordinary income and gains from certain derivative contracts are not eligible for qualifying investment.

Each Investor generally must invest Capital Gains into Opportunity Zone Fund within 180 days of realizing Capital Gains.

Investor generally must make an election to defer gain in the tax return for the year of the Capital Gains and the investment in the Opportunity Fund and are solely responsible for ensuring eligibility and qualification in each Investor's individual circumstances.

Many taxpayers can defer Capital Gains through Opportunity Fund investment including: individuals, C corporations (including REITs and RICs), partnerships and trusts.

Only investors with qualifying Capital Gains are eligible for Opportunity Fund tax benefits.

IRS and Treasury finalize Opportunity Zone guidance

FOR SALE DETAILS

PRICE

-

# OF LOTS

-

LAND DETAILS

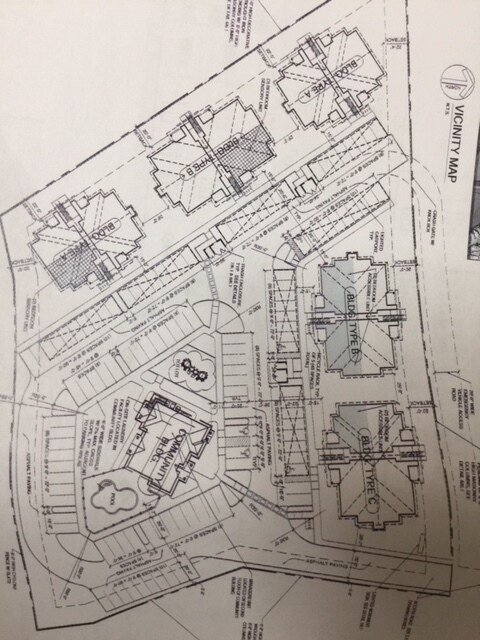

PROPERTY NAME

The Gardens

PROPERTY TYPE

Land

PROPERTY SUBTYPE

Commercial

LAND PROPOSED USE

Commercial, Apartment Units, Apartment Units - Condo, Apartment Units - Senior, Contractor Storage Yard, Hold for Development, Hold for Investment

LAND ACRES

-

LAND SF

-

OFFSITE IMPROVEMENTS

Sewer, Water, Electricity

ZONING

-

APN/PARCEL ID

-