14724 Inglewood Ave - Apartments FOR SALE

Lawndale, CA 90260 |

442-305-8774

14724 Inglewood Ave

Lawndale, CA 90260

HIGHLIGHTS

- Over $2.6 million in capital improvements since 2020, including seismic, electrical, and plumbing upgrades

- 44 of 50 units fully remodeled with modern interiors

- Secured building with gated access and parking for every unit

- In-place 6.15% cap rate with stabilized rents and no concessions

- Located across from Urth Caffé and near major retail anchors

- JV pricing and preferred equity options available with conversion flexibility

OVERVIEW

Positioned in the heart of Lawndale’s South Bay corridor, 14724 Inglewood Avenue presents a rare opportunity to acquire a stabilized, coastal-adjacent multifamily asset with significant upside. This 50-unit property, comprised predominantly of studio units, has undergone over $2.6 million in capital improvements since 2020, including seismic retrofitting, electrical and plumbing upgrades, and the full renovation of 44 interiors. The building is secured with gated access and offers dedicated parking for every unit—an uncommon amenity in this dense infill location.

The asset is currently operating at a 6.15% cap rate with in-place rents averaging $2,360 per unit and no concessions. With financing already secured at competitive terms and a pro forma gross rent potential of $1.41 million, investors can benefit from both immediate cash flow and long-term appreciation. The property’s location across from Urth Caffé and near major retailers like Home Depot and Best Buy enhances its walkability and tenant appeal.

CBK Investments, a seasoned South Bay syndicator with over 40 years of experience, is offering this asset with flexible JV structures, including preferred equity options backed by personal guarantees and the ability to convert to common shares after year one. This is a compelling opportunity for investors seeking a turnkey, income-producing asset with long-term redevelopment or repositioning potential in a high-demand coastal submarket.

FOR SALE DETAILS

BUILDING DETAILS

PROPERTY NAME

Palm View Village Lawndale

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

2

YEAR BUILT

1961

PARKING SPACES

50

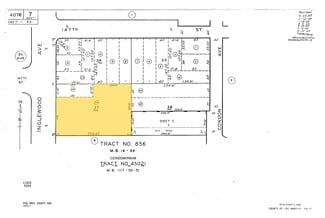

LAND DETAILS

LAND ACRES

0.87 AC

LAND SF

37,897 SF

ZONING

LNR3YY

APN/PARCEL ID

4078-007-023

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

442-305-8774

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

442-305-8774

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.