14 Lake St - Manufactured Housing/Mobile Housing FOR SALE

Frostproof, FL 33843 |

$3,500,000 USD

813-269-1144

14 Lake St

Frostproof, FL 33843

HIGHLIGHTS

- Call for Offers: DUE FEB 6 @ 5pm ET - SUBMIT TO JOSE VIALLO

- $3.5M Pricing | Fully Rebuilt Infrastructure, Scaled for Efficiency

- 2-3x value potential via phased infill and lease-up

- Institutional Baseline – Site-wide rehab: roads, utilities, pool, clubhouse, branding

- Dock Activation Optionality – 12 floating dock segments stored onsite, can be activated for boat slip income

- Polk County market faces affordable housing shortage

OVERVIEW

• Call for Offers: DUE FEB 6 @ 5pm ET - SUBMIT TO JOSE VIALLO

• Lane A: $2.95M cash (priority; certainty/fast close)

• Lane B: $3.5M structured with $1.75M min cash down

• CA required for appraisal/support + deal vault

• Tours only after written terms + POF

Dual-Use RV Asset with Affordable Housing Infill Strategy

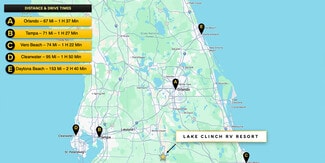

Lake Clinch RV Resort is a fully repositioned lakefront asset in Frostproof, Florida, with over $2M+ invested in infrastructure, utilities, and amenities. Zoned and engineered for multiple infill strategies, the asset supports two distinct monetization paths and benefits from the regional housing demand and waterfront location.

Track One: Traditional RV Lease-Up

The property includes 48 RV pads, 4 MH pads, and 3 apartments, all with upgraded utilities and infrastructure. As a turnkey resort with waterfront access, ongoing lease-up supports a projected $4.5M valuation at 95% occupancy per licensed appraisal.

Track Two: Workforce Rental Community (Owner’s Preferred Plan)

With rising housing demand in Polk County, the site is approved and engineered for 60 rentable duplex units (via 30 park model cabins) and 15 houseboats. This strategy aligns with appraised demand and delivers affordable housing at $795/month, supporting a projected $9.9M–$12M valuation based on third-party income analysis.

Appraisal-Backed Valuation Insight

A 59-page valuation report from MAI appraiser Keith Larson includes:

• $4.5M valuation at 95% occupancy of current asset

• $9.9M–$12M projection with duplex + houseboat overlays

Full appraisal available under NDA*

FOR SALE DETAILS

PRICE

$3,500,000 USD

PRICE/SF

$34 USD /SF

# OF UNITS

52

PRICE/UNIT

$67,308

CAP RATE

Request Cap Rate

% LEASED

-

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Lake Clinch RV Resort CALL FOR OFFERS

PROPERTY TYPE

Multi-Family

PROPERTY SUBTYPE

Manufactured Housing/Mobile Housing

TOTAL BUILDING SIZE

-

STORIES

1

YEAR BUILT

2025

PARKING SPACES

-

LAND DETAILS

LAND ACRES

2.36 AC

LAND SF

102,802 SF

ZONING

GC

APN/PARCEL ID

-

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

813-269-1144

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

813-269-1144

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.