$2,595,000 USD

914-262-2598

137-139 Willett Ave

Port Chester, NY 10573

Rye Brook/Port Chester

OVERVIEW

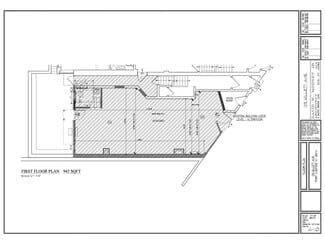

137–139 Willett Avenue is a 10-unit mixed-use investment property located in the heart of Port Chester’s rapidly evolving downtown, within the Rye Brook / Port Chester submarket. The three-story, ±7,821 SF building consists of eight residential apartments and two street-level retail storefronts , all separately metered for electric and boiler, providing operational efficiency and expense control. Built in 1900 and located within a federally designated Opportunity Zone, the asset benefits from a Walk Score of 93 (“Walker’s Paradise”) and is positioned just a one-minute walk from the Port Chester Metro-North Station on the New Haven Line, offering sub-40-minute access to Midtown Manhattan. Based on owner-provided rent roll and pro forma, the property generates $242,625 in total annual revenue, including $157,200 in residential rents, $77,025 in commercial rents, and $8,400 in CAM reimbursements, against annual operating expenses of $66,190, resulting in a Net Operating Income of $176,435. Offered at $2,595,000, the asset reflects an in-place cap rate of approximately 6.80%. Importantly, both the residential and commercial rent rolls include upcoming lease expirations, providing near- to mid-term opportunities to mark rents to market and drive NOI growth through re-leasing and strategic renewals. From an investment standpoint, Port Chester continues to emerge as one of Westchester County’s most compelling growth markets, driven by transit-oriented demand, downtown revitalization, and strong cultural gravity anchored by the Capitol Theatre and an expanding restaurant and retail scene along Willett Avenue. Residential demand is supported by strong household incomes, a growing daytime workforce, limited new walkable multifamily supply, and the stability of a diversified income stream. The Opportunity Zone designation further enhances long-term hold and repositioning potential for qualifying investors. Overall, 137–139 Willett Avenue represents a core-plus mixed-use opportunity offering immediate cash flow, embedded NOI upside, downside protection through diversified tenancy, and long-term appreciation tied to Port Chester’s continued reinvestment and upward trajectory.

FOR SALE DETAILS

PRICE

$2,595,000 USD

PRICE/SF

$332 USD /SF

# OF UNITS

10

PRICE/UNIT

$259,500

CAP RATE

6.8%

% LEASED

100%

SALE TYPE

Investment

BUILDING DETAILS

PROPERTY NAME

Mixed-Use | Opportunity Zone | InPlace Income

PROPERTY TYPE

Multi-Family

APARTMENT STYLE

Low-Rise

PROPERTY SUBTYPE

Apartments

TOTAL BUILDING SIZE

-

STORIES

3

YEAR BUILT

1900

PARKING SPACES

-

LAND DETAILS

LAND ACRES

0.07 AC

LAND SF

3,035 SF

ZONING

5

APN/PARCEL ID

4801-142-000-00023-001-0028-0000000

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

914-262-2598

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

914-262-2598

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.