135-Door Rental Portfolio, KY & IL Specialty FOR SALE

Paducah, KY |

$14,800,000 USD

270-331-4747

135-Door Rental Portfolio, KY & IL

Paducah, KY

OVERVIEW

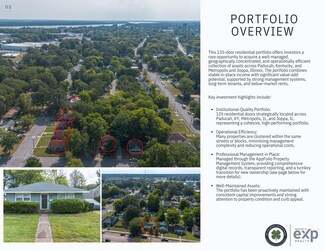

This 135-door residential portfolio offers investors a rare opportunity to acquire a well-managed, geographically concentrated, and operationally efficient collection of assets across Paducah, Kentucky, and Metropolis and Joppa, Illinois.

The portfolio combines stable in-place income with significant value-add potential, supported by strong management systems, long-term tenants, and below-market rents.

Key Investment Highlights include:

Institutional-Quality Portfolio: 135 residential doors strategically located across Paducah, KY, Metropolis, IL, and Joppa, IL, representing a cohesive, high-performing portfolio.

Operational Efficiency: Many properties are clustered within the same streets or blocks, minimizing management complexity and reducing operational costs.

Professional Management in Place: Managed through the AppFolio Property Management System, providing comprehensive digital records, transparent reporting, and a turnkey transition for new ownership.

Well-Maintained Assets: The portfolio has been proactively maintained with consistent capital improvements and strong attention to property condition and curb appeal.

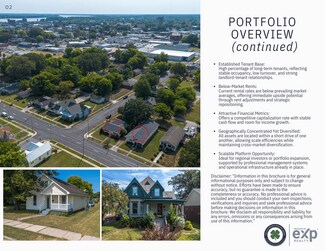

Established Tenant Base: High percentage of long-term tenants, reflecting stable occupancy, low turnover, and strong landlord-tenant relationships.

Below-Market Rents: Current rental rates are below prevailing market averages, offering immediate upside potential through rent adjustments and strategic repositioning.

Attractive Financial Metrics: Offers a competitive capitalization rate with stable cash flow and room for income growth.

Geographically Concentrated Yet Diversified: All assets are located within a short drive of one another, allowing scale efficiencies while maintaining cross-market diversification.

Scalable Platform Opportunity: Ideal for regional investors or portfolio expansion, supported by professional management systems and operational infrastructure already in place.

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

270-331-4747

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

270-331-4747

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.