$1,755,000 USD

352-400-2635

11218 US 301

Riverview, FL 33578

Southeast Tampa

OVERVIEW

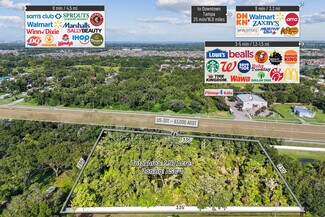

Get your shovel ready to develop this prime site in the Tampa/St Pete MSA a 1.97-acre parcel offers an exceptional combination of visibility, access, and development potential in the rapidly expanding Riverview market. With 335 feet of frontage on high-traffic US Highway 301 (63,000 AADT) and a depth of 285 feet, the site is well-suited for a wide range of future uses. Currently zoned ASC-1 (Agricultural – Single-Family Conventional, 1 du/acre), it lies within a transitional corridor surrounded by established commercial and mixed-use developments, presenting strong potential for rezoning to Commercial General (CG), Planned Development (PD), or mixed-use. The Flood Zone X designation indicates minimal flood risk, eliminating the need for costly flood insurance, and municipal water and sewer are available at the street to support higher-intensity development.

The property is located just north of the Symmes Road and US 301 intersection, in an area experiencing robust residential growth and steady commercial expansion. It sits approximately one mile south of a dining cluster featuring Chick-fil-A, Chipotle, and Black Rifle Coffee, and is close to daily-needs retailers such as Publix, 7-Eleven, and Circle K, along with service providers including Pacific Dental and Knockouts Haircuts & Grooming. Proposed dedicated left-in access from US 301 further enhances ingress accessibility to the site. This is a prime opportunity to secure a development site in one of Hillsborough County’s most active growth corridors.

The Tampa–St. Petersburg–Clearwater Metropolitan Statistical Area (MSA) is Florida’s second-largest metro and the 17th-largest in the United States, with a 2024 population exceeding 3.42 million. The region has grown approximately 7–8% since 2015, driven by strong domestic and international migration. It boasts a median household income of about $73,000 and a gross domestic product of roughly $243 billion, positioning it among the most dynamic mid-sized economies in the country. With a median age in the early 40s, the MSA offers a balanced consumer base and is anchored by key economic sectors including healthcare, finance, logistics via Port Tampa Bay, advanced manufacturing, tourism, and a rapidly growing technology industry—all contributing to resilient demand for commercial real estate across office, industrial, retail, and multifamily sectors.

Area Analysis

Tampa MSA at a Glance

*Population & Economy

-The MSA boasts over 3.3 million residents (17th largest in the U.S.), with a GDP topping roughly $243 billion in 2023 . Rapid population growth continues to drive demand across all commercial sectors—especially retail and multifamily.

*Breakout Sectors

-Healthcare: A powerhouse—more than 50 hospitals and many specialty clinics serve the region .

-Finance & Professional Services: Regional hubs for Raymond James, banks, and consultancies anchor a robust business services cluster .

-Logistics & Trade: Home to Florida’s busiest port, Port Tampa Bay, driving industrial and warehousing demand .

Commercial Market Deep Dive

*1. Office Sector

Q1 2025: Strong fundamentals—Westshore and Downtown show positive net absorption, a sign of sticky occupancy in core markets .

Q2 2025: Asking rents rose modestly to $31.68?FS, while vacancy held steady—stability where it matters .

*2. Industrial & Logistics

Q1 2025: Industrial demand remains solid, with logistics and e-commerce fueling leasing—but watch for slight softness as new supply enters the market .

*3. Retail Sector

Q1 2025 Snapshot:

-Total retail asset value stands at a hefty $48.1 billion, with $1.2 billion in sales over the past year.

-Average cap rate sits at a healthy 6.5%, while pricing is up about 3.7% per square foot year-over-year .

-Buyers skew local/private (64%), with national and institutional investors picking up the rest .

Power Submarkets & Drivers

-Westshore District: One of Florida’s most concentrated commercial corridors—with over 11 million SF of office space, 4,000 businesses, and 100,000+ employees . A magnet for corporate users and investors alike.

-Port Tampa Bay: Generates over $15 billion in economic impact and supports more than 80,000 jobs—critical to the region’s industrial backbone .

-Downtown & Airport Corridor: Elevated leasing in office and retail—proximity to employment, hotels, and the airport boost cadence.

Why This Matters for Commercial Opportunities

-Population & Job Growth Fuel Momentum: Long-term gains across retail, medical, office, and industrial sectors.

-Balanced Market Performance: Office remains stable in core submarkets; industrial is reliable; retail shows tired—but still positive—momentum.

-Investor Confidence is Tactile: Local/private investors lead—means capital stays in the region, hard to outbid locals for good sites.

Submarket Snapshot

Riverview is one of Hillsborough County’s fastest-growing corridors, with sustained residential infill along US-301 feeding daily trips to services, quick-serve, medical, and neighborhood retail. The subject sits on the US-301 arterial spine, benefiting from commuter patterns between Brandon, Gibsonton, and Southshore. Nearby land use is a mix of single-family neighborhoods, small-bay commercial, auto-oriented services, and scattered PD projects—classic “transition band” characteristics.

Access & Visibility

-Frontage: ±327.5’ directly on US-301 (major regional arterial; strong pylon/monument visibility).

-Depth: ±262’ (efficient for single- or dual-pad layouts plus on-site stormwater).

-Ingress/Egress: Full median openings and driveway spacing are FDOT-controlled; expect preference for 1 primary driveway with potential shared or cross-access to reduce conflict points. A secondary, right-in/right-out is often negotiable with an access plan.

Demand Drivers

-Residential base: Rapid housing growth within 1–3 miles supports daily-needs retail, medical, and service users.

-Commuter capture: Peak A.M./P.M. traffic funnels along US-301; drive-thru and convenience retail benefit most.

-Medical cluster trend: Suburban submarkets like Riverview continue to add urgent care, dental, imaging, and specialty clinics on arterials with easy turns and surface parking.

Competitive Context

The immediate corridor shows fragmented small-parcel commercial with PD and CG precedents nearby. That pattern favors:

-Pad users: QSR/coffee, convenience retail, auto-service, bank/ATM-lite (subject to any non-compete encumbrances).

-10–12k SF neighborhood strip: Multi-tenant with 1–3 anchors (fitness/martial arts, urgent care, dental, pet).

-8–10k SF medical/professional: Single or duplex footprint with shared parking.

FOR SALE DETAILS

PRICE

$1,755,000 USD

PRICE/ACRE

$900,000/AC

PRICE/SF

$21 USD /SF

# OF LOTS

-

LAND DETAILS

PROPERTY NAME

Prime 1.97 Ac On US 301 Riverview Land Opp.

PROPERTY TYPE

Land

PROPERTY SUBTYPE

Agricultural

LAND PROPOSED USE

Commercial, Agricultural, Single Family Residence

LAND ACRES

1.95 AC

LAND SF

84,942 SF

OFFSITE IMPROVEMENTS

-

ZONING

ASC-1

APN/PARCEL ID

077073-0000

ASK ABOUT THIS PROPERTY

Please correct the highlighted field(s).

352-400-2635

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.

Please correct the highlighted field(s).

352-400-2635

By clicking the button, you agree to Showcase's Terms of Use and Privacy Notice.